Form Pit-B - New Mexico Allocation And Apportionment Of Income Schedule - 2006

ADVERTISEMENT

*60580200*

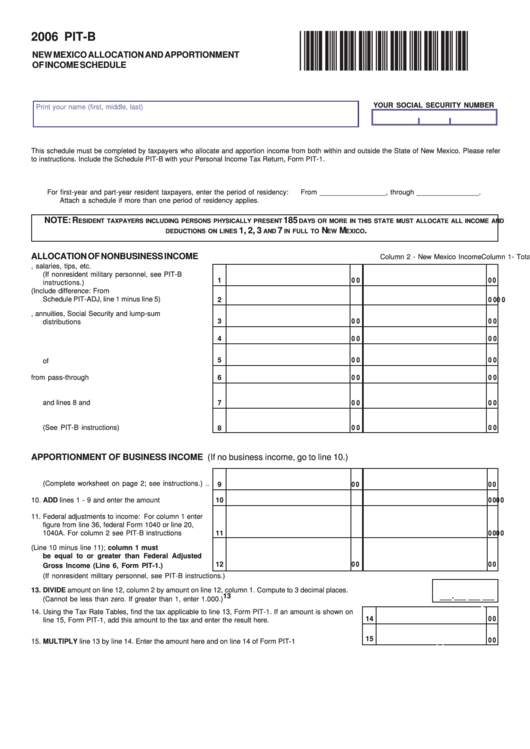

2006 PIT-B

NEW MEXICO ALLOCATION AND APPORTIONMENT

OF INCOME SCHEDULE

YOUR SOCIAL SECURITY NUMBER

Print your name (first, middle, last)

-

-

This schedule must be completed by taxpayers who allocate and apportion income from both within and outside the State of New Mexico. Please refer

to instructions. Include the Schedule PIT-B with your Personal Income Tax Return, Form PIT-1.

For first-year and part-year resident taxpayers, enter the period of residency:

From _________________, through ________________.

Attach a schedule if more than one period of residency applies.

NOTE: R

185

ESIDENT TAXPAYERS INCLUDING PERSONS PHYSICALLY PRESENT

DAYS OR MORE IN THIS STATE MUST ALLOCATE ALL INCOME AND

1, 2, 3

7

N

M

.

DEDUCTIONS ON LINES

AND

IN FULL TO

EW

EXICO

ALLOCATION OF NONBUSINESS INCOME

Column 1- Total Federal Income

Column 2 - New Mexico Income

1. Wages, salaries, tips, etc.

(If nonresident military personnel, see PIT-B

1

0 0

0 0

instructions.) ................................................................

2. Interest and dividends (Include difference: From

Schedule PIT-ADJ, line 1 minus line 5) .........................

2

0 0

0 0

3. Pensions, annuities, Social Security and lump-sum

3

0 0

0 0

distributions ..................................................................

4. Rents and royalties ......................................................

4

0 0

0 0

5. Gains or losses from the sale or exchange

5

0 0

0 0

of property ....................................................................

6. Income or losses from pass-through entities .............

6

0 0

0 0

7. All other income not included in lines 1 - 6

and lines 8 and 9 ..........................................................

7

0 0

0 0

8. Net operating loss carryforward

(See PIT-B instructions) ..............................................

0 0

0 0

8

APPORTIONMENT OF BUSINESS INCOME (If no business income, go to line 10.)

9. Business and farm income

(Complete worksheet on page 2; see instructions.) ..

9

0 0

0 0

10. ADD lines 1 - 9 and enter the amount here ................

10

0 0

0 0

11. Federal adjustments to income: For column 1 enter

figure from line 36, federal Form 1040 or line 20,

,

1040A. For column 2 see PIT-B instructions ..............

11

0 0

0 0

12. Total income (Line 10 minus line 11); column 1 must

be equal to or greater than Federal Adjusted

,

,

,

12

0 0

0 0

Gross Income (Line 6, Form PIT-1.) .......................

,

(If nonresident military personnel, see PIT-B instructions.)

13. DIVIDE amount on line 12, column 2 by amount on line 12, column 1. Compute to 3 decimal places.

__.__ __ __

.

(Cannot be less than zero. If greater than 1, enter 1.000.) ...................................................................................................... 13

14. Using the Tax Rate Tables, find the tax applicable to line 13, Form PIT-1. If an amount is shown on

14

0 0

line 15, Form PIT-1, add this amount to the tax and enter the result here. .........................................

,

,

15. MULTIPLY line 13 by line 14. Enter the amount here and on line 14 of Form PIT-1 ............................

15

0 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2