Form Pit-B - New Mexico Allocation And Apportionment Of Income Schedule - 2007

ADVERTISEMENT

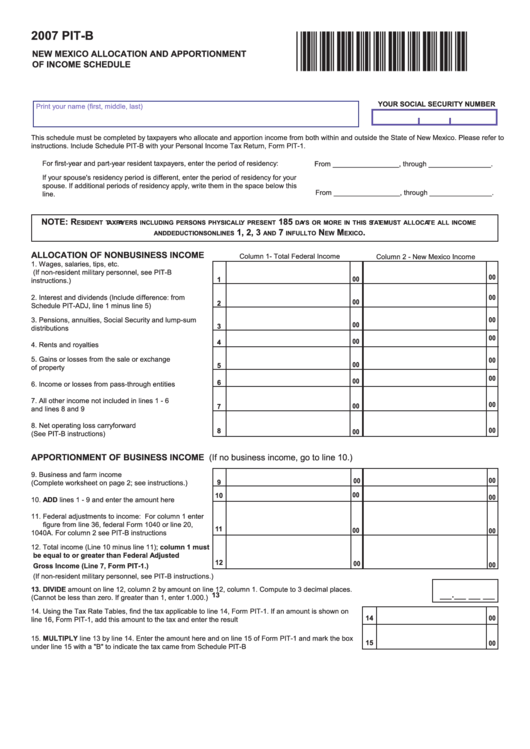

2007 PIT-B

*70580200*

NEW MEXICO ALLOCATION AND APPORTIONMENT

OF INCOME SCHEDULE

YOUR SOCIAL SECURITY NUMBER

Print your name (first, middle, last)

This schedule must be completed by taxpayers who allocate and apportion income from both within and outside the State of New Mexico. Please refer to

instructions. Include Schedule PIT-B with your Personal Income Tax Return, Form PIT-1.

For first-year and part-year resident taxpayers, enter the period of residency:

From _________________, through ________________.

If your spouse's residency period is different, enter the period of residency for your

spouse. If additional periods of residency apply, write them in the space below this

From _________________, through ________________.

line.

NOTE: R

185

EsidENT TaxpayERs iNcludiNg pERsONs physically pREsENT

days OR mORE iN This sTaTE musT allOcaTE all iNcOmE

1, 2, 3

7

N

m

.

aNd dEducTiONs ON liNEs

aNd

iN full TO

Ew

ExicO

ALLOCATION OF NONBUSINESS INCOME

Column 1- Total Federal Income

Column 2 - New Mexico Income

1. Wages, salaries, tips, etc.

(If non-resident military personnel, see PIT-B

00

00

1

instructions.) ..................................................................

2. Interest and dividends (Include difference: from

00

00

2

Schedule PIT-ADJ, line 1 minus line 5) .........................

00

3. Pensions, annuities, Social Security and lump-sum

00

3

distributions ...................................................................

00

00

4

4. Rents and royalties ........................................................

5. Gains or losses from the sale or exchange

00

00

5

of property .....................................................................

00

00

6

6. Income or losses from pass-through entities .................

7. All other income not included in lines 1 - 6

00

00

7

and lines 8 and 9 ...........................................................

8. Net operating loss carryforward

00

8

00

(See PIT-B instructions) ................................................

APPORTIONMENT OF BUSINESS INCOME (If no business income, go to line 10.)

9. Business and farm income

00

00

9

(Complete worksheet on page 2; see instructions.) ......

00

10

00

10. ADD lines 1 - 9 and enter the amount here ...................

11. Federal adjustments to income: For column 1 enter

figure from line 36, federal Form 1040 or line 20,

11

00

00

1040A. For column 2 see PIT-B instructions .................

12. Total income (Line 10 minus line 11); column 1 must

be equal to or greater than Federal Adjusted

12

00

00

Gross Income (Line 7, Form PIT-1.) ...........................

(If non-resident military personnel, see PIT-B instructions.)

13. DIVIDE amount on line 12, column 2 by amount on line 12, column 1. Compute to 3 decimal places.

__.__ __ __

(Cannot be less than zero. If greater than 1, enter 1.000.) ........................................................................................................ 13

14. Using the Tax Rate Tables, find the tax applicable to line 14, Form PIT-1. If an amount is shown on

14

00

line 16, Form PIT-1, add this amount to the tax and enter the result here..................................................

15. MULTIPLY line 13 by line 14. Enter the amount here and on line 15 of Form PIT-1 and mark the box

15

00

under line 15 with a "B" to indicate the tax came from Schedule PIT-B .....................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2