Instructions For Form 720 - Kentucky Corporation Income Tax And Llet Return - 2013

ADVERTISEMENT

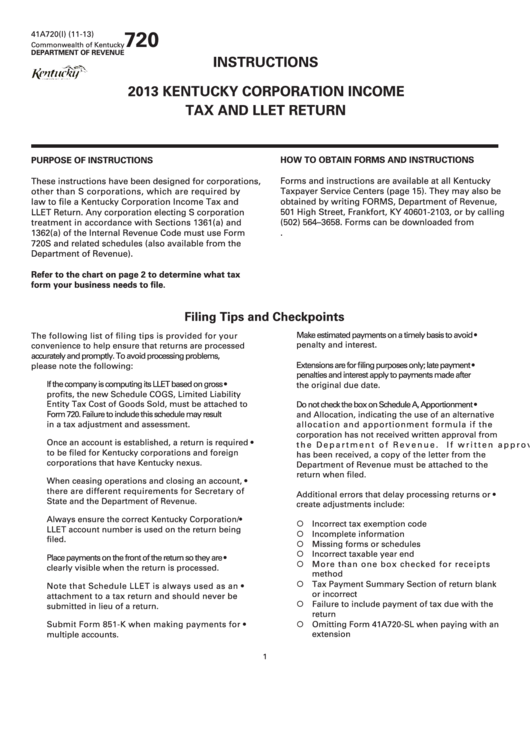

720

41A720(I) (11-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS

2013 KENTUCKY CORPORATION INCOME

TAX AND LLET RETURN

PURPOSE OF INSTRUCTIONS

HOW TO OBTAIN FORMS AND INSTRUCTIONS

These instructions have been designed for corporations,

Forms and instructions are available at all Kentucky

other than S corporations, which are required by

Taxpayer Service Centers (page 15). They may also be

obtained by writing FORMS, Department of Revenue,

law to file a Kentucky Corporation Income Tax and

501 High Street, Frankfort, KY 40601-2103, or by calling

LLET Return. Any corporation electing S corporation

treatment in accordance with Sections 1361(a) and

(502) 564–3658. Forms can be downloaded from www.

1362(a) of the Internal Revenue Code must use Form

revenue.ky.gov.

720S and related schedules (also available from the

Department of Revenue).

Refer to the chart on page 2 to determine what tax

form your business needs to file.

Filing Tips and Checkpoints

•

Make estimated payments on a timely basis to avoid

The following list of filing tips is provided for your

penalty and interest.

convenience to help ensure that returns are processed

accurately and promptly. To avoid processing problems,

•

Extensions are for filing purposes only; late payment

please note the following:

penalties and interest apply to payments made after

•

If the company is computing its LLET based on gross

the original due date.

profits, the new Schedule COGS, Limited Liability

Entity Tax Cost of Goods Sold, must be attached to

•

Do not check the box on Schedule A, Apportionment

Form 720. Failure to include this schedule may result

and Allocation, indicating the use of an alternative

in a tax adjustment and assessment.

allocation and appor tionment formula if the

corporation has not received written approval from

•

Once an account is established, a return is required

the Department of Revenue. If written approval

to be filed for Kentucky corporations and foreign

has been received, a copy of the letter from the

corporations that have Kentucky nexus.

Department of Revenue must be attached to the

return when filed.

•

When ceasing operations and closing an account,

there are different requirements for Secretary of

•

Additional errors that delay processing returns or

State and the Department of Revenue.

create adjustments include:

•

Always ensure the correct Kentucky Corporation/

¡ Incorrect tax exemption code

LLET account number is used on the return being

¡ Incomplete information

filed.

¡ Missing forms or schedules

¡ Incorrect taxable year end

•

Place payments on the front of the return so they are

¡ More than one box checked for receipts

clearly visible when the return is processed.

method

¡ Tax Payment Summary Section of return blank

•

Note that Schedule LLET is always used as an

or incorrect

attachment to a tax return and should never be

¡ Failure to include payment of tax due with the

submitted in lieu of a return.

return

¡ Omitting Form 41A720-SL when paying with an

•

Submit Form 851-K when making payments for

extension

multiple accounts.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20