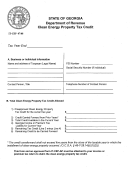

PROPERTY TAX APPEAL FORM

Page 2 of 3

Read directions on first page before completing

FOR CTAB USE ONLY

File this appeal with the Clerk and Recorder in the County in which the property is located. File on or

before the First Monday in June or within 30 days of the time you receive your Notice of

Date Filed :

Assessment or revised assessment notice of real property subject to taxation or your

Assessment list of personal property from the Montana Department of Revenue. (for the purpose

Docket # :

of a tax appeal, your notice of taxes due from the County Treasurer is not considered a notice of

change or assessment.) You may also appeal a decision made by the Department of Revenue based

Received by :

upon your informal review. You must file the appeal of the outcome of the informal review conference

within 30 days of the receipt of the Department of Revenue decision.

THE FOLLOWING SECTION MUST BE COMPLETED IN FULL

Taxpayer Information

Legal Description of Property

Name of Taxpayer

Lot(s)

:

as shown on tax rolls

Block(s)

Mailing Address

Addition/Subdivision

City/Town

(NAME)

County

City/Town

Zip Code

Street Address

Contact Phone No.

Was an AB-26 Form filed with the DOR?

Alternate Phone No.

If YES/Date

No

YES

No. of Acres:

Section:

Township:

Range:

GEO Code:

Appraised Value as Determined

Appraised Value set by County

Appraised Value set by

by Taxpayer

Board Decision

Department of Revenue

Land

Buildings

Personal Property

Reason for Appeal:

Name of Taxpayer:

Date:

Signature of taxpayer: ____________________________________________

I hereby Authorize

(name of agent) to represent me in this matter.

Date:

Signature of taxpayer:____________________________________________

1

1 2

2 3

3