VENDING OPTIONS

VENDING OPTIONS

Taxpayers are given 3 options to manage their vending operations in Arkansas. All vending machines must display a vending device decal, no matter which

option is chosen.

Option 1 involves the payment of sales tax directly to the supplier of all merchandise to be sold through the taxpayer's vending machines. Food sold through a

vending machine can qualify for taxation at the 1.5% Reduced Food Tax rate. No Sales/Use Tax permit is required. A one-time registration is required, at which

time decals are ordered for placement on the vending machines. Each fiscal year, decals are re-ordered and placed on the vending machines. There is no fee

for Option 1 decals.

Option 2 involves reporting/paying the 7% Wholesale Vending Tax (see Rule 1995-2) each month on the merchandise to be sold through the taxpayer's vending

machines. Merchandise is purchased tax free under the sale for resale exemption. The taxpayer files an ET-1 Excise Tax Report and pays the 7% tax. A one-

time registration is required, at which time decals are ordered for placement on the vending machines. Each fiscal year, decals are re-ordered and placed on the

vending machines. There is no fee for Option 2 decals.

Option 3 involves exempting vending merchandise purchases from tax under the sale for resale exemption. A one-time registration is required, at which time

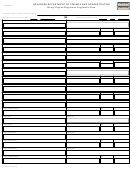

decals are purchased (see Section B Option and Decal Selection). The vending machine operator purchases these annual decals based on various factors -

manual verses electric vending equipment, value of the vended goods, and bulk verses individually vended goods.

VENDING DEVICE DEFINITIONS

A. Coin-Operated Vending Devices - any and all machines or devices which upon the payment or insertion of a coin, token or similar object, dispenses

tangible personal property, including but not limited to candies, gum, cold drinks, hot drinks, sandwiches, chips, ballpoint pens, cigarette lighters, soaps or

detergents, or other edible or inedible items. Coin-operated vending devices do not include:

1) Amusement and game machines

2) Devices used exclusively for the purpose of selling cigarettes, newspapers, magazines or postage stamps

3) Devices used for the purpose of selling services such as pay telephone booths, parking meters, gas and electric meters

4) Automatic teller machine, compressed air, or other devices used in the distribution of such needed services

B. Coin-Operated Bulk Vending Devices - machines or devices containing unsorted merchandise which, upon insertion of a coin or coins, dispenses the

merchandise, either manually or electronically, in approximately equal portions, at random and without selection by the customer. Such vending

machines

are a simple mechanical device capable of accepting a coin of only one denomination with one coin slot. Sorted or unsorted merchandise dispensed by such

vending machines include gum, candy, toys, novelties, or other similar merchandise.

C. Coin-Operated Manually-Powered Vending Devices - any and all machines or devices which use manual power, rather than electromotive power, for

dispensing products and which upon payment or insertion of coins, tokens, or similar objects, dispense the type of tangible personal property described in A.

D. Operator - the person who (as owner, lessee, bailee or otherwise) is responsible for removing money from the vending device and is otherwise responsible

for reporting and paying the applicable general or special sales taxes on purchases of tangible personal property subject to sale through the vending device.

VENDING DEVICE INFORMATION

A. An operator can not choose to have part of his or her vending devices covered by the decal fee, while other vending devices during the decal registration year

would be subject to the general or special sales taxes that would be applicable to the purchase of tangible personal property subject to sale through the

vending devices.

B. Requirements to obtain vending device decal:

1) Must not be a convicted felon or a corporation whose president or principal shareholders are convicted felons.

2) If selecting Option 2 or 3, must have obtained from the Director of the Department of Finance and Administration an Arkansas Gross Receipts (Sales)

Tax permit.

Page 2 of 2

Merchandise Vending Registration Supplement Form - AR-1R-VEN (R 10/31/12)

1

1 2

2