Reset Form

ALC 83

Rev. 8/11

P.O. Box 530

Columbus, OH

43216-0530

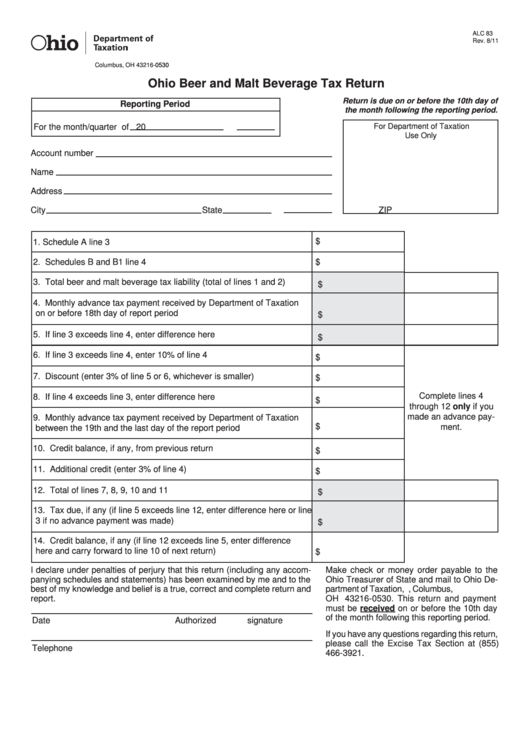

Ohio Beer and Malt Beverage Tax Return

Return is due on or before the 10th day of

Reporting Period

the month following the reporting period.

For Department of Taxation

For the month/quarter of

20

Use Only

Account number

Name

Address

City

State

ZIP

$

1. Schedule A line 3

2. Schedules B and B1 line 4

$

3. Total beer and malt beverage tax liability (total of lines 1 and 2)

$

4. Monthly advance tax payment received by Department of Taxation

on or before 18th day of report period

$

5. If line 3 exceeds line 4, enter difference here

$

6. If line 3 exceeds line 4, enter 10% of line 4

$

7. Discount (enter 3% of line 5 or 6, whichever is smaller)

$

Complete lines 4

8. If line 4 exceeds line 3, enter difference here

$

through 12 only if you

made an advance pay-

9. Monthly advance tax payment received by Department of Taxation

$

ment.

between the 19th and the last day of the report period

10. Credit balance, if any, from previous return

$

11. Additional credit (enter 3% of line 4)

$

12. Total of lines 7, 8, 9, 10 and 11

$

13. Tax due, if any (if line 5 exceeds line 12, enter difference here or line

3 if no advance payment was made)

$

14. Credit balance, if any (if line 12 exceeds line 5, enter difference

here and carry forward to line 10 of next return)

$

I declare under penalties of perjury that this return (including any accom-

Make check or money order payable to the

panying schedules and statements) has been examined by me and to the

Ohio Treasurer of State and mail to Ohio De-

best of my knowledge and belief is a true, correct and complete return and

partment of Taxation, P.O. Box 530, Columbus,

report.

OH 43216-0530. This return and payment

must be received on or before the 10th day

of the month following this reporting period.

Date

Authorized signature

If you have any questions regarding this return,

please call the Excise Tax Section at (855)

Telephone

466-3921.

1

1 2

2