Instructions For Form Alc 36 - Monthly Ohio Wine And Mixed Beverage Tax Return

ADVERTISEMENT

ALC 36I

Rev. 3/08

P.O. Box 530

Columbus, OH

43216-0530

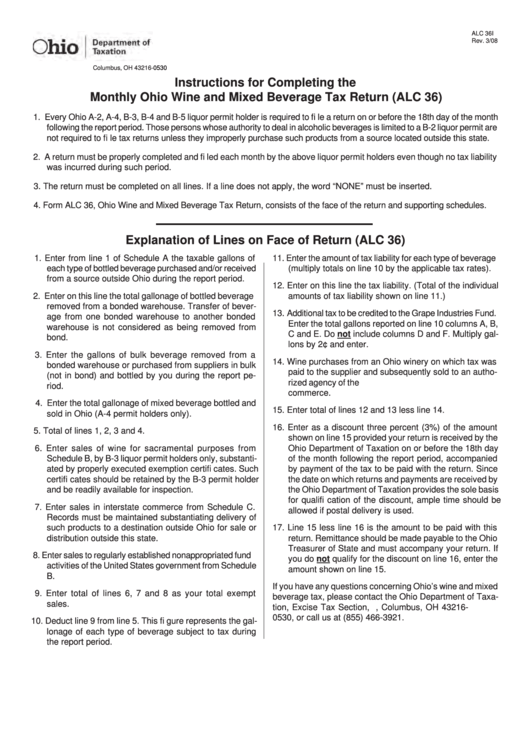

Instructions for Completing the

Monthly Ohio Wine and Mixed Beverage Tax Return (ALC 36)

1. Every Ohio A-2, A-4, B-3, B-4 and B-5 liquor permit holder is required to fi le a return on or before the 18th day of the month

following the report period. Those persons whose authority to deal in alcoholic beverages is limited to a B-2 liquor permit are

not required to fi le tax returns unless they improperly purchase such products from a source located outside this state.

2. A return must be properly completed and fi led each month by the above liquor permit holders even though no tax liability

was incurred during such period.

3. The return must be completed on all lines. If a line does not apply, the word “NONE” must be inserted.

4. Form ALC 36, Ohio Wine and Mixed Beverage Tax Return, consists of the face of the return and supporting schedules.

Explanation of Lines on Face of Return (ALC 36)

1. Enter from line 1 of Schedule A the taxable gallons of

11. Enter the amount of tax liability for each type of beverage

each type of bottled beverage purchased and/or received

(multiply totals on line 10 by the applicable tax rates).

from a source outside Ohio during the report period.

12. Enter on this line the tax liability. (Total of the individual

2. Enter on this line the total gallonage of bottled beverage

amounts of tax liability shown on line 11.)

removed from a bonded warehouse. Transfer of bever-

13. Additional tax to be credited to the Grape Industries Fund.

age from one bonded warehouse to another bonded

Enter the total gallons reported on line 10 columns A, B,

warehouse is not considered as being removed from

C and E. Do not include columns D and F. Multiply gal-

bond.

lons by 2¢ and enter.

3. Enter the gallons of bulk beverage removed from a

14. Wine purchases from an Ohio winery on which tax was

bonded warehouse or purchased from suppliers in bulk

paid to the supplier and subsequently sold to an autho-

(not in bond) and bottled by you during the report pe-

rized agency of the U.S. government or sold in interstate

riod.

commerce.

4. Enter the total gallonage of mixed beverage bottled and

15. Enter total of lines 12 and 13 less line 14.

sold in Ohio (A-4 permit holders only).

16. Enter as a discount three percent (3%) of the amount

5. Total of lines 1, 2, 3 and 4.

shown on line 15 provided your return is received by the

6. Enter sales of wine for sacramental purposes from

Ohio Department of Taxation on or before the 18th day

Schedule B, by B-3 liquor permit holders only, substanti-

of the month following the report period, accompanied

ated by properly executed exemption certifi cates. Such

by payment of the tax to be paid with the return. Since

certifi cates should be retained by the B-3 permit holder

the date on which returns and payments are received by

and be readily available for inspection.

the Ohio Department of Taxation provides the sole basis

for qualifi cation of the discount, ample time should be

7. Enter sales in interstate commerce from Schedule C.

allowed if postal delivery is used.

Records must be maintained substantiating delivery of

such products to a destination outside Ohio for sale or

17. Line 15 less line 16 is the amount to be paid with this

distribution outside this state.

return. Remittance should be made payable to the Ohio

Treasurer of State and must accompany your return. If

8. Enter sales to regularly established nonappropriated fund

you do not qualify for the discount on line 16, enter the

activities of the United States government from Schedule

amount shown on line 15.

B.

If you have any questions concerning Ohio’s wine and mixed

9. Enter total of lines 6, 7 and 8 as your total exempt

beverage tax, please contact the Ohio Department of Taxa-

sales.

tion, Excise Tax Section, P.O. 530, Columbus, OH 43216-

0530, or call us at (855) 466-3921.

10. Deduct line 9 from line 5. This fi gure represents the gal-

lonage of each type of beverage subject to tax during

the report period.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1