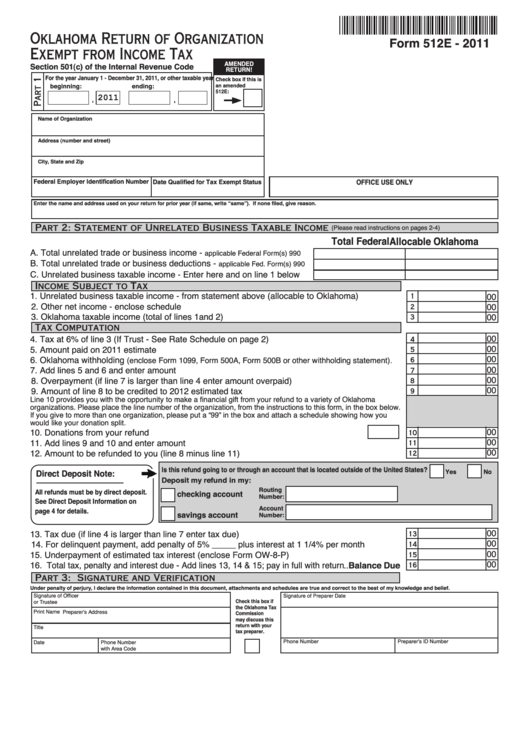

Oklahoma Return of Organization

Form 512E - 2011

Exempt from Income Tax

AMENDED

Section 501(c) of the Internal Revenue Code

RETURN!

For the year January 1 - December 31, 2011, or other taxable year

Check box if this is

beginning:

ending:

an amended

512E:

2011

,

,

Name of Organization

Address (number and street)

City, State and Zip

Federal Employer Identification Number

OFFICE USE ONLY

Date Qualified for Tax Exempt Status

Enter the name and address used on your return for prior year (if same, write “same”). If none filed, give reason.

Part 2: Statement of Unrelated Business Taxable Income

(Please read instructions on pages 2-4)

Total Federal

Allocable Oklahoma

A. Total unrelated trade or business income -

applicable Federal Form(s) 990

B. Total unrelated trade or business deductions -

applicable Fed. Form(s) 990

C. Unrelated business taxable income - Enter here and on line 1 below

Income Subject to Tax

1. Unrelated business taxable income - from statement above (allocable to Oklahoma) .............

00

1

2. Other net income - enclose schedule .......................................................................................

00

2

3. Oklahoma taxable income (total of lines 1and 2) ......................................................................

00

3

Tax Computation

00

4. Tax at 6% of line 3 (If Trust - See Rate Schedule on page 2) ..................................................

4

00

5. Amount paid on 2011 estimate..................................................................................................

5

00

6. Oklahoma withholding

(enclose Form 1099, Form 500A, Form 500B or other withholding statement).

6

00

7. Add lines 5 and 6 and enter amount .........................................................................................

7

00

8. Overpayment (if line 7 is larger than line 4 enter amount overpaid) ........................................

8

00

9. Amount of line 8 to be credited to 2012 estimated tax .............................................................

9

Line 10 provides you with the opportunity to make a financial gift from your refund to a variety of Oklahoma

organizations. Please place the line number of the organization, from the instructions to this form, in the box below.

If you give to more than one organization, please put a “99” in the box and attach a schedule showing how you

would like your donation split.

00

10. Donations from your refund ........................................................................................

10

00

11. Add lines 9 and 10 and enter amount .......................................................................................

11

00

12. Amount to be refunded to you (line 8 minus line 11) ..................................................... Refund

12

Is this refund going to or through an account that is located outside of the United States?

Direct Deposit Note:

Yes

No

Deposit my refund in my:

Routing

All refunds must be by direct deposit.

checking account

Number:

See Direct Deposit Information on

Account

page 4 for details.

savings account

Number:

00

13. Tax due (if line 4 is larger than line 7 enter tax due) ....................................................Tax Due

13

00

14. For delinquent payment, add penalty of 5% _____ plus interest at 1 1/4% per month .............

14

00

15. Underpayment of estimated tax interest (enclose Form OW-8-P) ............................................

15

00

16. Total tax, penalty and interest due - Add lines 13, 14 & 15; pay in full with return..Balance Due

16

Part 3: Signature and Verification

Under penalty of perjury, I declare the information contained in this document, attachments and schedules are true and correct to the best of my knowledge and belief.

Signature of Officer

Signature of Preparer

Date

Check this box if

or Trustee

the Oklahoma Tax

Print Name

Preparer’s Address

Commission

may discuss this

return with your

Title

tax preparer.

Phone Number

Preparer’s ID Number

Date

Phone Number

with Area Code

1

1 2

2 3

3 4

4