F

71R

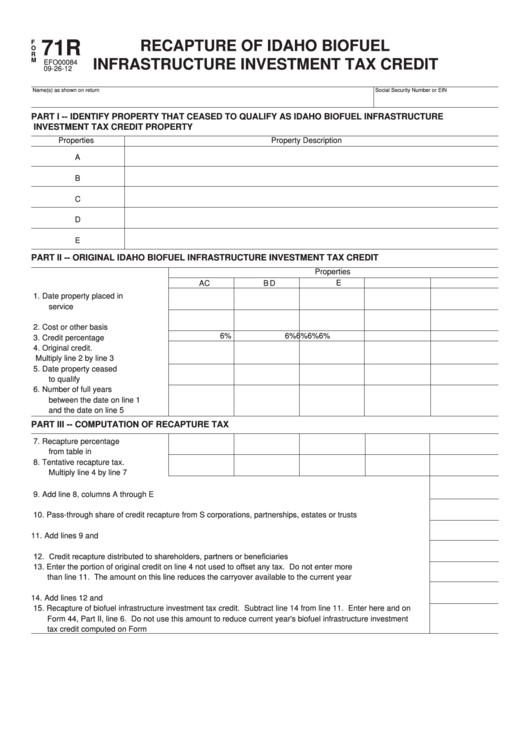

RECAPTURE OF IDAHO BIOFUEL

O

R

M

INFRASTRUCTURE INVESTMENT TAX CREDIT

EFO00084

09-26-12

Name(s) as shown on return

Social Security Number or EIN

PART I -- IDENTIFY PROPERTY THAT CEASED TO QUALIFY AS IDAHO BIOFUEL INFRASTRUCTURE

INVESTMENT TAX CREDIT PROPERTY

Properties

Property Description

A

B

C

D

E

PART II -- ORIGINAL IDAHO BIOFUEL INFRASTRUCTURE INVESTMENT TAX CREDIT

Properties

D

E

A

B

C

1. Date property placed in

service ........................................

2. Cost or other basis ......................

6%

6%

6%

6%

6%

3. Credit percentage .......................

4. Original credit.

Multiply line 2 by line 3 ................

5. Date property ceased

to qualify .....................................

6. Number of full years

between the date on line 1

and the date on line 5 .................

PART III -- COMPUTATION OF RECAPTURE TAX

7. Recapture percentage

from table in instructions.............

8. Tentative recapture tax.

Multiply line 4 by line 7 ...............

9. Add line 8, columns A through E .........................................................................................................................

10. Pass-through share of credit recapture from S corporations, partnerships, estates or trusts .............................

11. Add lines 9 and 10...............................................................................................................................................

1 2. Credit recapture distributed to shareholders, partners or beneficiaries...............................................................

13. Enter the portion of original credit on line 4 not used to offset any tax. Do not enter more

than line 11. The amount on this line reduces the carryover available to the current year ................................

14. Add lines 12 and 13.............................................................................................................................................

15. Recapture of biofuel infrastructure investment tax credit. Subtract line 14 from line 11. Enter here and on

Form 44, Part II, line 6. Do not use this amount to reduce current year's biofuel infrastructure investment

tax credit computed on Form 71..........................................................................................................................

1

1 2

2