INSTRUCTIONS

WHO MUST FILE

Each licensed special fuel dealer must file this report with all applicable supporting schedules

each month. This report is required even though there may be no tax-free gallons to list as received

or distributed.

WHEN TO FILE

The report is due on or before the 25th day of the month following the month covered by the

report. Example: The January report is due on February 25. Failure to timely file a monthly

report will result in loss of compensation (line 20) and imposition of late filing penalties.

PAYMENT

Payment of the tax due must accompany the report. The monthly payment must be made by

electronic funds transfer to Kentucky State Treasurer. Failure to timely remit all special fuel tax

due will result in loss of compensation (line 20) and imposition of late pay penalties and interest.

EXTENSION OF TIME

Notify the Motor Fuels Tax Compliance Section in the event you need to extend the filing date.

Payment of not less than 95 percent of the total tax liability is required to extend the filing date of

the special fuel monthly report. If the estimated payment is filed timely then the completed 72A138

and support schedules with any remaining tax payment is due on the last day of the month.

TAX RATE

The special fuel tax rate is set quarterly and is effective for a quarterly period. Notification of the

tax rate is mailed 20 days before the beginning of each calendar quarter. Example: Dealers are

notified by March 10 of the tax rate effective for April, May and June.

RECORDS RETENTION

Licensed dealers must keep all records relating to the receipt and distribution of special fuel for

a period of five years. Such records include invoices, bills of lading, delivery tickets, meter

readings and any other documents relating to the dealer's motor fuel activity.

PETROLEUM STORAGE

TANK ENVIRONMENTAL

ASSURANCE FEE

MONTHLY REPORT

Each licensed special fuel dealer must also file Form 72A011, Petroleum Storage Tank

Environmental Assurance Fee Monthly Report. The fee computed on special fuel gallons is based

on taxable special fuel shown on line 13 of this report.

STATISTICAL

GALLONS

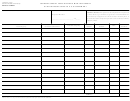

Part III gallons are the total gallons of special fuel, specifically road use (clear) diesel, purchased

at the terminal rack for import into Kentucky and on which the Kentucky special fuel excise tax

was precollected by the supplier. Attach Form 72A179 (Schedule 1).

ASSISTANCE AND

INFORMATION

Telephone

(502) 564-3853

Address Correspondence

Department of Revenue

Motor Fuels Tax Compliance Section, Station 63

P.O. Box 1303

Frankfort, KY 40602-1303

1

1 2

2