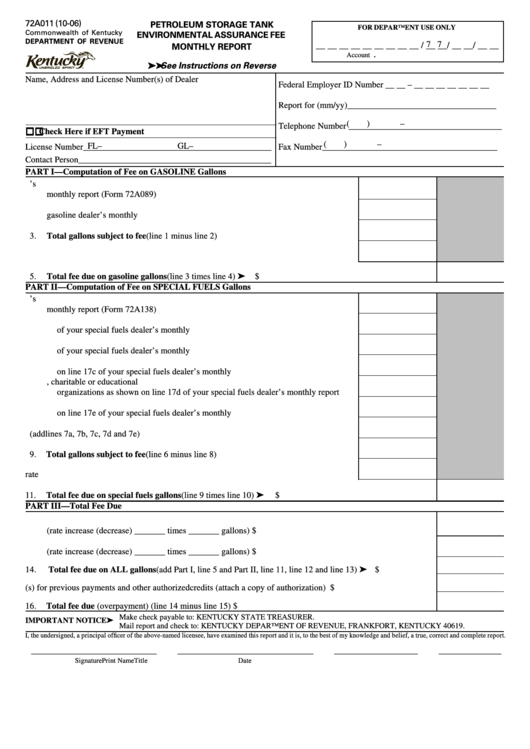

72A011 (10-06)

PETROLEUM STORAGE TANK

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

ENVIRONMENTAL ASSURANCE FEE

DEPARTMENT OF REVENUE

7 7

__ __ __ __ __ __ __ __ __ / __ __ / __ __ / __ __

MONTHLY REPORT

.

Account Number

Tax

Mo.

Yr

➤ ➤ ➤ ➤ ➤ See Instructions on Reverse

Name, Address and License Number(s) of Dealer

Federal Employer ID Number __ __ – __ __ __ __ __ __ __

Report for (mm/yy) __________________________________

(

)

–

Telephone Number ___________________________________

Check Here if EFT Payment

(

)

–

FL–

GL–

License Number ___________________________________________

Fax Number ________________________________________

Contact Person ____________________________________________

PART I—Computation of Fee on GASOLINE Gallons

1.

Taxable gallons as shown on line 11 of your gasoline dealer’s

monthly report (Form 72A089) .........................................................................................

2.

Less agricultural gasoline gallons as reflected on line 15a of your

gasoline dealer’s monthly report ........................................................................................

3.

Total gallons subject to fee (line 1 minus line 2) .............................................................

4.

Fee rate ...............................................................................................................................

x

.014

Total fee due on gasoline gallons (line 3 times line 4) .................................................................................. ➤

5.

$

PART II—Computation of Fee on SPECIAL FUELS Gallons

6.

Taxable gallons as shown on line 13 of your special fuels dealer’s

monthly report (Form 72A138) .........................................................................................

7.

a. Less agricultural special fuels gallons as reflected on line 17a

of your special fuels dealer’s monthly report ...............................................................

b. Less residential heating special fuels gallons as reported on line 17b

of your special fuels dealer’s monthly report ...............................................................

c. Less special fuels gallons sold to state or local government agencies as shown

on line 17c of your special fuels dealer’s monthly report .............................................

d. Less special fuels gallons sold to nonprofit religious, charitable or educational

organizations as shown on line 17d of your special fuels dealer’s monthly report ......

e. Less special fuels gallons sold for commercial use of diesel as shown

on line 17e of your special fuels dealer’s monthly report .............................................

8.

Total deductions (add lines 7a, 7b, 7c, 7d and 7e) .............................................................

9.

Total gallons subject to fee (line 6 minus line 8) .............................................................

10.

Fee rate ...............................................................................................................................

x

.014

Total fee due on special fuels gallons (line 9 times line 10) ............................................................................. ➤

11.

$

PART III—Total Fee Due

12.

Fee rate adjustment for gasoline gallons inventory held in wholesale bulk storage on last day of period.

(rate increase (decrease) _______ times _______ gallons) ..................................................................................... $

13.

Fee rate adjustment for special fuels gallons inventory held in wholesale bulk storage on last day of period.

(rate increase (decrease) _______ times _______ gallons) ..................................................................................... $

Total fee due on ALL gallons (add Part I, line 5 and Part II, line 11, line 12 and line 13) ............................... ➤ $

14.

15.

Credit(s) for previous payments and other authorized credits (attach a copy of authorization) ............................. $

16.

Total fee due (overpayment) (line 14 minus line 15) ............................................................................................. $

Make check payable to: KENTUCKY STATE TREASURER.

IMPORTANT NOTICE ➤

Mail report and check to: KENTUCKY DEPARTMENT OF REVENUE, FRANKFORT, KENTUCKY 40619.

I, the undersigned, a principal officer of the above-named licensee, have examined this report and it is, to the best of my knowledge and belief, a true, correct and complete report.

________________________

__________________________

________________

____________

Signature

Print Name

Title

Date

1

1 2

2