Form 4241 - Tobacco Products Tax Payment/proposed Adjustments Coupon

ADVERTISEMENT

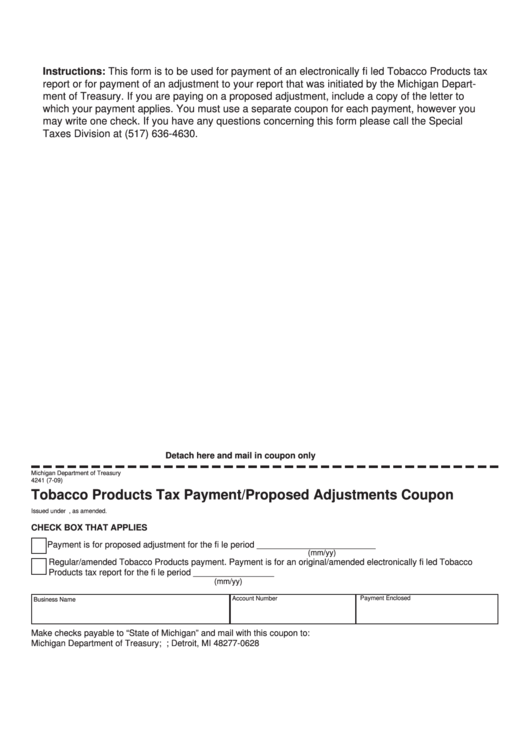

Instructions: This form is to be used for payment of an electronically fi led Tobacco Products tax

report or for payment of an adjustment to your report that was initiated by the Michigan Depart-

ment of Treasury. If you are paying on a proposed adjustment, include a copy of the letter to

which your payment applies. You must use a separate coupon for each payment, however you

may write one check. If you have any questions concerning this form please call the Special

Taxes Division at (517) 636-4630.

Detach here and mail in coupon only

Michigan Department of Treasury

4241 (7-09)

Tobacco Products Tax Payment/Proposed Adjustments Coupon

Issued under P.A. 327 of 1993, as amended.

CHECK BOX THAT APPLIES

Payment is for proposed adjustment for the fi le period _________________________

(mm/yy)

Regular/amended Tobacco Products payment. Payment is for an original/amended electronically fi led Tobacco

Products tax report for the fi le period _________________

(mm/yy)

Account Number

Payment Enclosed

Business Name

Make checks payable to “State of Michigan” and mail with this coupon to:

Michigan Department of Treasury; P.O. Box 77628; Detroit, MI 48277-0628

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1