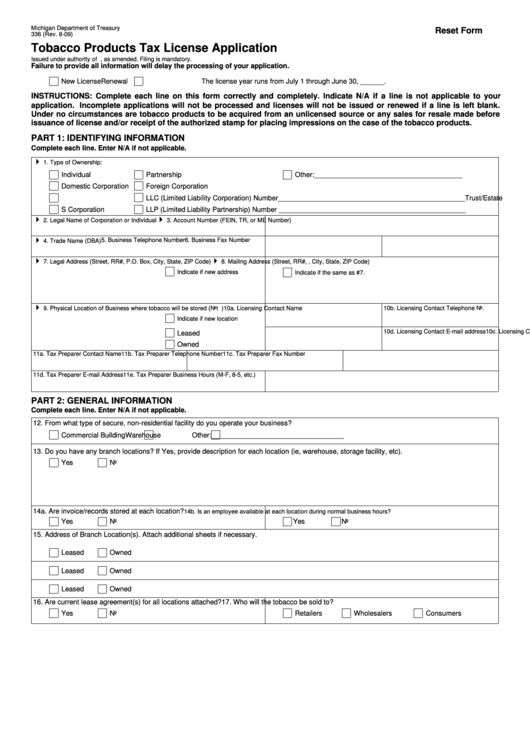

Michigan Department of Treasury

Reset Form

336 (Rev. 8-09)

Tobacco Products Tax License Application

Issued under authority of P.A. 327 of 1993, as amended. Filing is mandatory.

Failure to provide all information will delay the processing of your application.

New License

Renewal

The license year runs from July 1 through June 30, ______.

INSTRUCTIONS: Complete each line on this form correctly and completely. Indicate N/A if a line is not applicable to your

application. Incomplete applications will not be processed and licenses will not be issued or renewed if a line is left blank.

Under no circumstances are tobacco products to be acquired from an unlicensed source or any sales for resale made before

issuance of license and/or receipt of the authorized stamp for placing impressions on the case of the tobacco products.

PART 1: IDENTIFYING INFORMATION

Complete each line. Enter N/A if not applicable.

1. Type of Ownership:

Individual

Partnership

Other:______________________________________

Domestic Corporation

Foreign Corporation

Trust/Estate

LLC (Limited Liability Corporation) Number________________________________________________

S Corporation

LLP (Limited Liability Partnership) Number ________________________________________________

2. Legal Name of Corporation or Individual

3. Account Number (FEIN, TR, or ME Number)

5. Business Telephone Number

6. Business Fax Number

4. Trade Name (DBA)

7. Legal Address (Street, RR#, P.O. Box, City, State, ZIP Code)

8. Mailing Address (Street, RR#, P.O. Box, City, State, ZIP Code)

Indicate if new address

Indicate if the same as #7.

9. Physical Location of Business where tobacco will be stored (Not P.O. Box)

10a. Licensing Contact Name

10b. Licensing Contact Telephone No.

Indicate if new location

10c. Licensing Contact Fax Number

10d. Licensing Contact E-mail address

Leased

Owned

11a. Tax Preparer Contact Name

11b. Tax Preparer Telephone Number

11c. Tax Preparer Fax Number

11d. Tax Preparer E-mail Address

11e. Tax Preparer Business Hours (M-F, 8-5, etc.)

PART 2: GENERAL INFORMATION

Complete each line. Enter N/A if not applicable.

12. From what type of secure, non-residential facility do you operate your business?

Commercial Building

Warehouse

Other:__________________________________

13. Do you have any branch locations? If Yes, provide description for each location (ie, warehouse, storage facility, etc).

Yes

No

14a. Are invoice/records stored at each location?

14b. Is an employee available at each location during normal business hours?

Yes

No

Yes

No

15. Address of Branch Location(s). Attach additional sheets if necessary.

Leased

Owned

Leased

Owned

Leased

Owned

16. Are current lease agreement(s) for all locations attached?

17. Who will the tobacco be sold to?

Yes

No

Retailers

Wholesalers

Consumers

1

1 2

2 3

3 4

4