Form Tsb-M-08(1)m - Wholesale Dealers Of Tobacco Products To Begin Filing Monthly Informational Returns

ADVERTISEMENT

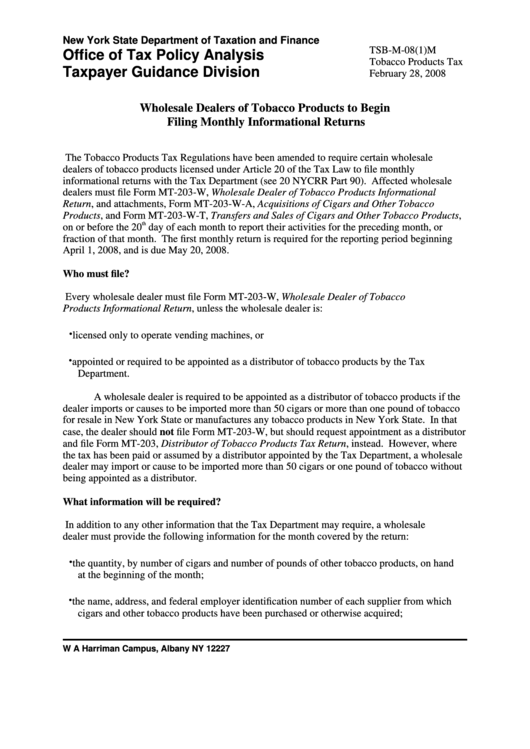

New York State Department of Taxation and Finance

TSB-M-08(1)M

Office of Tax Policy Analysis

Tobacco Products Tax

Taxpayer Guidance Division

February 28, 2008

Wholesale Dealers of Tobacco Products to Begin

Filing Monthly Informational Returns

The Tobacco Products Tax Regulations have been amended to require certain wholesale

dealers of tobacco products licensed under Article 20 of the Tax Law to file monthly

informational returns with the Tax Department (see 20 NYCRR Part 90). Affected wholesale

dealers must file Form MT-203-W, Wholesale Dealer of Tobacco Products Informational

Return, and attachments, Form MT-203-W-A, Acquisitions of Cigars and Other Tobacco

Products, and Form MT-203-W-T, Transfers and Sales of Cigars and Other Tobacco Products,

th

on or before the 20

day of each month to report their activities for the preceding month, or

fraction of that month. The first monthly return is required for the reporting period beginning

April 1, 2008, and is due May 20, 2008.

Who must file?

Every wholesale dealer must file Form MT-203-W, Wholesale Dealer of Tobacco

Products Informational Return, unless the wholesale dealer is:

·

licensed only to operate vending machines, or

·

appointed or required to be appointed as a distributor of tobacco products by the Tax

Department.

A wholesale dealer is required to be appointed as a distributor of tobacco products if the

dealer imports or causes to be imported more than 50 cigars or more than one pound of tobacco

for resale in New York State or manufactures any tobacco products in New York State. In that

case, the dealer should not file Form MT-203-W, but should request appointment as a distributor

and file Form MT-203, Distributor of Tobacco Products Tax Return, instead. However, where

the tax has been paid or assumed by a distributor appointed by the Tax Department, a wholesale

dealer may import or cause to be imported more than 50 cigars or one pound of tobacco without

being appointed as a distributor.

What information will be required?

In addition to any other information that the Tax Department may require, a wholesale

dealer must provide the following information for the month covered by the return:

·

the quantity, by number of cigars and number of pounds of other tobacco products, on hand

at the beginning of the month;

·

the name, address, and federal employer identification number of each supplier from which

cigars and other tobacco products have been purchased or otherwise acquired;

W A Harriman Campus, Albany NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2