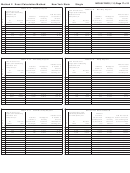

New York State Withholding Tax Tables And Methods Page 10

ADVERTISEMENT

Page 10 of 22

EXEMPTIONS CLAIMED

10

WAGES

At

But

0

1

2

3

4

5

6

7

8

9

or more

NYS-50-T-NYS (1/16)

Least

Less Than

TAX TO BE WITHHELD

$0

$200

$0.00

Method I

200

400

0.00

400

460

0.00

460

480

0.00

Table IV

480

500

0.00

500

520

0.00

0.00

520

540

540

560

0.00

NY STATE

560

580

0.00

580

600

0.00

Income Tax

600

640

0.10

640

680

1.70

680

720

3.30

$0.00

720

760

4.90

1.60

6.50

3.20

$0.00

760

800

SINGLE

800

840

8.10

4.80

1.50

840

880

9.70

6.40

3.10

$0.00

880

920

11.30

8.00

4.70

1.30

920

960

12.90

9.60

6.30

2.90

$0.00

960

1,000

14.50

11.20

7.90

4.50

1.20

MONTHLY

1,000

1,040

16.10

12.80

9.50

6.10

2.80

17.70

14.40

11.10

7.70

4.40

$1.10

1,040

1,080

Payroll Period

1,080

1,120

19.30

16.00

12.70

9.30

6.00

2.70

1,120

1,160

20.90

17.60

14.30

10.90

7.60

4.30

$0.90

1,160

1,200

22.50

19.20

15.90

12.50

9.20

5.90

2.50

1,200

1,240

24.10

20.80

17.50

14.10

10.80

7.50

4.10

$0.80

1,240

1,280

25.70

22.40

19.10

15.70

12.40

9.10

5.70

2.40

1,280

1,320

27.30

24.00

20.70

17.30

14.00

10.70

7.30

4.00

$0.70

1,320

1,360

29.00

25.60

22.30

18.90

15.60

12.30

8.90

5.60

2.30

30.80

27.20

23.90

20.50

17.20

13.90

10.50

7.20

3.90

$0.50

1,360

1,400

1,400

1,440

32.60

28.90

25.50

22.10

18.80

15.50

12.10

8.80

5.50

2.10

1,440

1,480

34.40

30.70

27.10

23.70

20.40

17.10

13.70

10.40

7.10

3.70

$0.40

1,480

1,520

36.20

32.50

28.70

25.30

22.00

18.70

15.30

12.00

8.70

5.30

2.00

1,520

1,560

38.00

34.30

30.50

26.90

23.60

20.30

16.90

13.60

10.30

6.90

3.60

1,560

1,600

39.80

36.10

32.30

28.60

25.20

21.90

18.50

15.20

11.90

8.50

5.20

1,600

1,640

41.90

37.90

34.10

30.40

26.80

23.50

20.10

16.80

13.50

10.10

6.80

1,640

1,680

44.00

39.70

35.90

32.20

28.40

25.10

21.70

18.40

15.10

11.70

8.40

46.10

41.70

37.70

34.00

30.20

26.70

23.30

20.00

16.70

13.30

10.00

1,680

1,720

1,720

1,760

48.20

43.80

39.50

35.80

32.00

28.30

24.90

21.60

18.30

14.90

11.60

1,760

1,800

50.40

45.90

41.50

37.60

33.80

30.10

26.50

23.20

19.90

16.50

13.20

1,800

1,840

52.70

48.00

43.60

39.40

35.60

31.90

28.10

24.80

21.50

18.10

14.80

1,840

1,880

55.10

50.20

45.70

41.30

37.40

33.70

29.90

26.40

23.10

19.70

16.40

1,880

1,920

57.50

52.50

47.80

43.40

39.20

35.50

31.70

28.00

24.70

21.30

18.00

1,920

1,960

59.80

54.90

50.00

45.50

41.20

37.30

33.50

29.80

26.30

22.90

19.60

1,960

2,000

62.20

57.30

52.30

47.60

43.30

39.10

35.30

31.60

27.90

24.50

21.20

64.50

59.60

54.70

49.70

45.40

41.00

37.10

33.40

29.60

26.10

22.80

2,000

2,040

2,040

2,080

66.90

62.00

57.10

52.10

47.50

43.10

38.90

35.20

31.40

27.70

24.40

2,080

2,120

69.30

64.30

59.40

54.50

49.60

45.20

40.80

37.00

33.20

29.50

26.00

2,120

2,160

71.60

66.70

61.80

56.90

51.90

47.30

42.90

38.80

35.00

31.30

27.60

2,160

2,200

74.00

69.10

64.10

59.20

54.30

49.40

45.00

40.60

36.80

33.10

29.30

2,200

2,240

76.30

71.40

66.50

61.60

56.70

51.80

47.10

42.70

38.60

34.90

31.10

2,240

2,280

78.70

73.80

68.90

63.90

59.00

54.10

49.20

44.80

40.50

36.70

32.90

2,280

2,320

81.10

76.10

71.20

66.30

61.40

56.50

51.60

46.90

42.60

38.50

34.70

2,320

2,360

83.40

78.50

73.60

68.70

63.70

58.80

53.90

49.00

44.70

40.30

36.50

2,360

2,400

85.80

80.90

75.90

71.00

66.10

61.20

56.30

51.40

46.80

42.40

38.30

2,400

2,440

88.20

83.20

78.30

73.40

68.50

63.60

58.60

53.70

48.90

44.50

40.10

2,440

2,480

90.80

85.60

80.70

75.70

70.80

65.90

61.00

56.10

51.20

46.60

42.20

2,480

2,520

93.40

88.00

83.00

78.10

73.20

68.30

63.40

58.40

53.50

48.70

44.30

2,520

2,560

96.00

90.60

85.40

80.50

75.50

70.60

65.70

60.80

55.90

51.00

46.40

2,560

2,600

98.60

93.20

87.80

82.80

77.90

73.00

68.10

63.20

58.20

53.30

48.50

101.10

95.80

90.40

85.20

80.30

75.40

70.40

65.50

60.60

55.70

50.80

2,600

2,640

2,640

2,680

103.70

98.30

93.00

87.60

82.60

77.70

72.80

67.90

63.00

58.00

53.10

2,680

2,720

106.30 100.90

95.60

90.20

85.00

80.10

75.20

70.20

65.30

60.40

55.50

Use Method II, “Exact Calculation Method,” on pages 16 and 17.

$2,720 & OVER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22