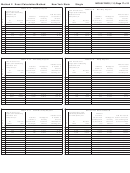

New York State Withholding Tax Tables And Methods Page 13

ADVERTISEMENT

Page 13 of 22

EXEMPTIONS CLAIMED

10

WAGES

At

But

0

1

2

3

4

5

6

7

8

9

or more

NYS-50-T-NYS (1/16)

Least

Less Than

TAX TO BE WITHHELD

$0

$27

$0.00

Method I

27

28

0.00

28

29

0.00

29

30

0.00

Table V

30

31

0.00

31

32

0.00

0.10

32

33

33

34

0.10

NY STATE

34

35

0.20

35

36

0.20

$0.10

Income Tax

36

37

0.20

0.10

37

38

0.30

0.10

38

39

0.30

0.20

39

40

0.40

0.20

$0.10

0.40

0.30

0.10

40

41

MARRIED

41

42

0.40

0.30

0.10

42

43

0.50

0.30

0.20

43

44

0.50

0.40

0.20

$0.10

44

45

0.60

0.40

0.30

0.10

45

46

0.60

0.50

0.30

0.10

DAILY

46

47

0.60

0.50

0.30

0.20

$0.00

0.70

0.50

0.40

0.20

0.10

47

48

Payroll Period

48

49

0.70

0.60

0.40

0.30

0.10

49

50

0.80

0.60

0.50

0.30

0.10

50

52

0.80

0.70

0.50

0.40

0.20

$0.10

52

54

0.90

0.80

0.60

0.40

0.30

0.10

54

56

1.00

0.80

0.70

0.50

0.40

0.20

$0.10

56

58

1.10

0.90

0.80

0.60

0.40

0.30

0.10

58

60

1.10

1.00

0.80

0.70

0.50

0.40

0.20

$0.10

1.20

1.10

0.90

0.80

0.60

0.50

0.30

0.10

60

62

62

64

1.30

1.20

1.00

0.80

0.70

0.50

0.40

0.20

$0.10

64

66

1.40

1.20

1.10

0.90

0.80

0.60

0.50

0.30

0.20

66

68

1.50

1.30

1.20

1.00

0.80

0.70

0.50

0.40

0.20

$0.10

68

70

1.60

1.40

1.20

1.10

0.90

0.80

0.60

0.50

0.30

0.20

70

72

1.70

1.50

1.30

1.20

1.00

0.90

0.70

0.50

0.40

0.20

$0.10

72

74

1.80

1.60

1.40

1.20

1.10

0.90

0.80

0.60

0.50

0.30

0.20

74

76

1.80

1.70

1.50

1.30

1.20

1.00

0.90

0.70

0.60

0.40

0.20

1.90

1.80

1.60

1.40

1.20

1.10

0.90

0.80

0.60

0.50

0.30

76

78

78

80

2.10

1.90

1.70

1.50

1.30

1.20

1.00

0.90

0.70

0.60

0.40

80

82

2.20

2.00

1.80

1.60

1.40

1.30

1.10

0.90

0.80

0.60

0.50

82

84

2.30

2.10

1.90

1.70

1.50

1.30

1.20

1.00

0.90

0.70

0.60

84

86

2.40

2.20

2.00

1.80

1.60

1.40

1.30

1.10

1.00

0.80

0.60

86

88

2.50

2.30

2.10

1.90

1.70

1.50

1.30

1.20

1.00

0.90

0.70

88

90

2.60

2.40

2.20

2.00

1.80

1.60

1.40

1.30

1.10

1.00

0.80

90

92

2.70

2.50

2.30

2.10

1.90

1.70

1.50

1.40

1.20

1.00

0.90

2.90

2.60

2.40

2.20

2.00

1.80

1.60

1.40

1.30

1.10

1.00

92

94

94

96

3.00

2.70

2.50

2.30

2.10

1.90

1.70

1.50

1.40

1.20

1.00

96

98

3.10

2.90

2.60

2.40

2.20

2.00

1.80

1.60

1.50

1.30

1.10

98

100

3.20

3.00

2.80

2.50

2.30

2.10

1.90

1.70

1.50

1.40

1.20

100

102

3.30

3.10

2.90

2.60

2.40

2.20

2.00

1.80

1.60

1.50

1.30

102

104

3.40

3.20

3.00

2.80

2.50

2.30

2.10

1.90

1.70

1.50

1.40

104

106

3.60

3.30

3.10

2.90

2.70

2.40

2.20

2.00

1.80

1.60

1.50

106

108

3.70

3.50

3.20

3.00

2.80

2.50

2.30

2.10

1.90

1.70

1.60

108

110

3.80

3.60

3.30

3.10

2.90

2.70

2.40

2.20

2.00

1.80

1.60

110

112

3.90

3.70

3.50

3.20

3.00

2.80

2.60

2.30

2.10

1.90

1.70

112

114

4.00

3.80

3.60

3.40

3.10

2.90

2.70

2.40

2.20

2.00

1.80

114

116

4.20

3.90

3.70

3.50

3.20

3.00

2.80

2.60

2.30

2.10

1.90

116

118

4.30

4.00

3.80

3.60

3.40

3.10

2.90

2.70

2.50

2.20

2.00

118

120

4.40

4.20

3.90

3.70

3.50

3.30

3.00

2.80

2.60

2.30

2.10

120

122

4.50

4.30

4.10

3.80

3.60

3.40

3.10

2.90

2.70

2.50

2.20

4.70

4.40

4.20

3.90

3.70

3.50

3.30

3.00

2.80

2.60

2.40

122

124

124

126

4.80

4.60

4.30

4.10

3.80

3.60

3.40

3.20

2.90

2.70

2.50

126

128

4.90

4.70

4.40

4.20

3.90

3.70

3.50

3.30

3.00

2.80

2.60

128

130

5.10

4.80

4.60

4.30

4.10

3.80

3.60

3.40

3.20

2.90

2.70

Use Method II, “Exact Calculation Method,” on pages 18 and 19.

$130 & OVER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22