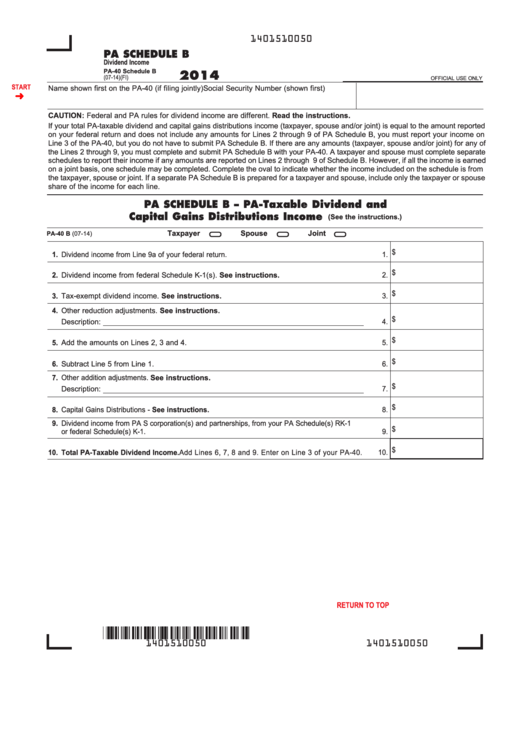

1401510050

PA SCHEDULE B

Dividend Income

PA-40 Schedule B

2014

(07-14)(FI)

OFFICIAL USE ONLY

START

Name shown first on the PA-40 (if filing jointly)

Social Security Number (shown first)

CAUTION: Federal and PA rules for dividend income are different. Read the instructions.

If your total PA-taxable dividend and capital gains distributions income (taxpayer, spouse and/or joint) is equal to the amount reported

on your federal return and does not include any amounts for Lines 2 through 9 of PA Schedule B, you must report your income on

Line 3 of the PA-40, but you do not have to submit PA Schedule B. If there are any amounts (taxpayer, spouse and/or joint) for any of

the Lines 2 through 9, you must complete and submit PA Schedule B with your PA-40. A taxpayer and spouse must complete separate

schedules to report their income if any amounts are reported on Lines 2 through 9 of Schedule B. However, if all the income is earned

on a joint basis, one schedule may be completed. Complete the oval to indicate whether the income included on the schedule is from

the taxpayer, spouse or joint. If a separate PA Schedule B is prepared for a taxpayer and spouse, include only the taxpayer or spouse

share of the income for each line.

PA SCHEDULE B – PA-Taxable Dividend and

Capital Gains Distributions Income

(See the instructions.)

Taxpayer

Spouse

Joint

PA-40 B (07-14)

1. $

1. Dividend income from Line 9a of your federal return.

2. $

2. Dividend income from federal Schedule K-1(s). See instructions.

3. $

3. Tax-exempt dividend income. See instructions.

4. Other reduction adjustments. See instructions.

4. $

Description:

5. $

5. Add the amounts on Lines 2, 3 and 4.

6. $

6. Subtract Line 5 from Line 1.

7. Other addition adjustments. See instructions.

7. $

Description:

8. $

8. Capital Gains Distributions - See instructions.

9. Dividend income from PA S corporation(s) and partnerships, from your PA Schedule(s) RK-1

9. $

or federal Schedule(s) K-1.

10. $

10. Total PA-Taxable Dividend Income. Add Lines 6, 7, 8 and 9. Enter on Line 3 of your PA-40.

PRINT FORM

Reset Entire Form

RETURN TO TOP

1401510050

1401510050

1

1