Clear Form

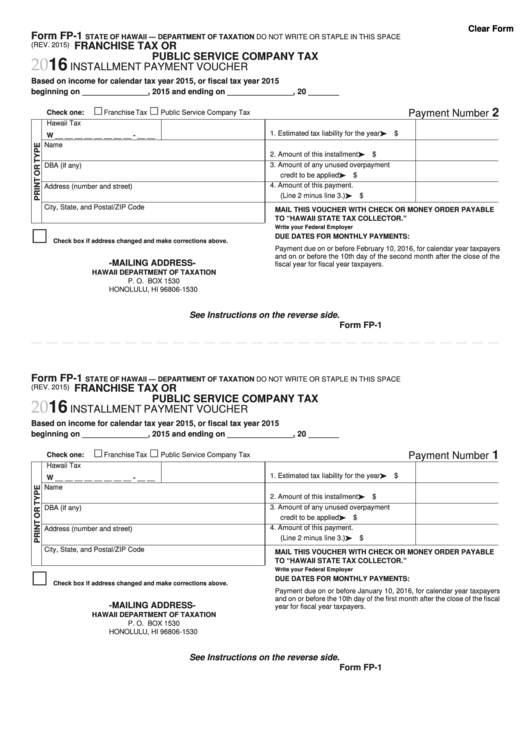

Form FP-1

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

FRANCHISE TAX OR

(REV. 2015)

PUBLIC SERVICE COMPANY TAX

2016

INSTALLMENT PAYMENT VOUCHER

Based on income for calendar tax year 2015, or fiscal tax year 2015

beginning on _______________, 2015 and ending on _______________, 20 _______

2

Payment Number

Check one:

Franchise Tax

Public Service Company Tax

Hawaii Tax I.D. No.

Federal Employer I.D. No.

1. Estimated tax liability for the year .............

$

W __ __ __ __ __ __ __ __ - __ __

Name

2. Amount of this installment ........................

$

DBA (if any)

3. Amount of any unused overpayment

credit to be applied ...................................

$

Address (number and street)

4. Amount of this payment.

(Line 2 minus line 3.) ................................

$

City, State, and Postal/ZIP Code

MAIL THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE

TO “HAWAII STATE TAX COLLECTOR.”

Write your Federal Employer I.D. Number on your check or money order.

DUE DATES FOR MONTHLY PAYMENTS:

Check box if address changed and make corrections above.

Payment due on or before February 10, 2016, for calendar year taxpayers

and on or before the 10th day of the second month after the close of the

-MAILING ADDRESS-

fiscal year for fiscal year taxpayers.

HAWAII DEPARTMENT OF TAXATION

P. O. BOX 1530

HONOLULU, HI 96806-1530

See Instructions on the reverse side.

Form FP-1

Form FP-1

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

(REV. 2015)

FRANCHISE TAX OR

PUBLIC SERVICE COMPANY TAX

2016

INSTALLMENT PAYMENT VOUCHER

Based on income for calendar tax year 2015, or fiscal tax year 2015

beginning on _______________, 2015 and ending on _______________, 20 _______

1

Payment Number

Check one:

Franchise Tax

Public Service Company Tax

Hawaii Tax I.D. No.

Federal Employer I.D. No.

1. Estimated tax liability for the year .............

$

W __ __ __ __ __ __ __ __ - __ __

Name

2. Amount of this installment ........................

$

DBA (if any)

3. Amount of any unused overpayment

credit to be applied ...................................

$

Address (number and street)

4. Amount of this payment.

(Line 2 minus line 3.) ................................

$

City, State, and Postal/ZIP Code

MAIL THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE

TO “HAWAII STATE TAX COLLECTOR.”

Write your Federal Employer I.D. Number on your check or money order.

DUE DATES FOR MONTHLY PAYMENTS:

Check box if address changed and make corrections above.

Payment due on or before January 10, 2016, for calendar year taxpayers

and on or before the 10th day of the first month after the close of the fiscal

-MAILING ADDRESS-

year for fiscal year taxpayers.

HAWAII DEPARTMENT OF TAXATION

P. O. BOX 1530

HONOLULU, HI 96806-1530

See Instructions on the reverse side.

Form FP-1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12