Form Fq-1 - Estimated Tax Installment Voucher - City Of Fairborn - 2003

ADVERTISEMENT

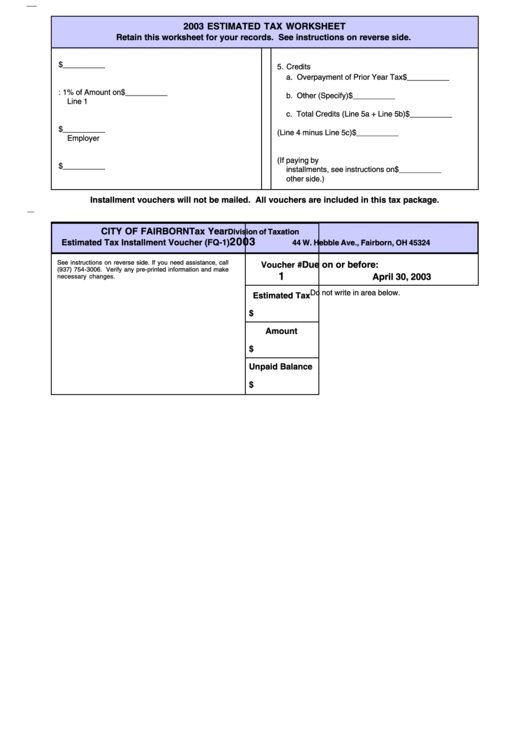

2003 ESTIMATED TAX WORKSHEET

Retain this worksheet for your records. See instructions on reverse side.

1. Income Subject to Fairborn Tax

$ __________

5. Credits

a. Overpayment of Prior Year Tax

$ __________

2. Fairborn Tax: 1% of Amount on

$ __________

b. Other (Specify)

$ __________

Line 1

c. Total Credits (Line 5a + Line 5b)

$ __________

3. Less Fairborn Tax Withheld by

$ __________

6. Net Tax Due (Line 4 minus Line 5c)

$ __________

Employer

7. Quarterly Installment (If paying by

4. Balance of Estimated Fairborn Tax

$ __________

installments, see instructions on

$ __________

other side.)

Installment vouchers will not be mailed. All vouchers are included in this tax package.

CITY OF FAIRBORN

Tax Year

Division of Taxation

2003

Estimated Tax Installment Voucher (FQ-1)

44 W. Hebble Ave., Fairborn, OH 45324

See instructions on reverse side. If you need assistance, call

Due on or before:

Voucher #

(937) 754-3006. Verify any pre-printed information and make

1

April 30, 2003

necessary changes.

Do not write in area below.

Estimated Tax

$

Amount

$

Unpaid Balance

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2