Regulation .10 Natural and Artificial Gas, Electricity, Steam, Oil and Coal

A. Consumption in Production Activities.

(1) The sale of gas, electricity, steam, oil or coal, consumed directly and predominantly in a production activity

is not subject to the tax. Production activities do not include processing food or a beverage by a retail food

vendor or operating administrative or commercial facilities, such as offices, sales and display rooms, retail

outlets and storage facilities, including refrigerated storage facilities.

(2) If electricity, gas or steam is sold through a single meter for both exempt and taxable uses, the purpose which

consumes the majority of the electricty, gas or steam is the basis for determining the taxability of the sale.

The buyer shall determine the majority usage, considering the relative connected load for each purpose and

the relative time of operation of each over a period of one year, unless the cirumstances of a perticular case

require a different period. Similarly, the taxability of purchases of oil or coal is determined by the majority use

where it is impracticable to measure separately the amount purchased for each purpose.

(3) If the sale of electricity or natural gas is exempt from tax, the sale of the transmission, distribution, or delivery

of that electricity or natural gas is also exempt from tax.

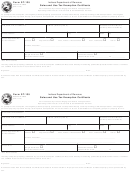

(4) In order to obtain this exclusion, the buyer of gas, electricity, steam, oil or coal shall present to the vendor

of the commodity and the vendor of the transmission, distribution, or delivery service a certification, upon a

form available from the comptroller, setting forth the basis for the claimed exemption. Upon presentation of

the completed and signed form, the vendor may not collect the tax until notified by the comptroller to resume

collection or until the certification is revoked by the buyer. The buyer shall revoke the certification when no

longer entitled to exclusion under the terms of this regulation.

B. Exempt Buyers.

(1) A person operating a non-profit religious, charitable, or educational organization possessing an exemption

certificate issued by the comptroller under Regulation .22, and other persons possessing an exemption

certifiate issued by the comptoller, may claim exemption for the tax on gas, electricity, steam, oil, coal or the

transmission, distribution, or delivery of electricity or natural gas by providing a photocopy of this certificate to

the vendor.

(2) A member of a foreign diplomatic corps may purchase gas, electricity, steam, oil, coal or the transmission,

distribution, or delivery of electricity or natural gas free of tax by presenting to the vendor the evidence of

exemption issued by the United States Department of State.

********************************

Special Instructions for Restaurants and Other Food Servers

Purchases of utilities and fuel by retail food vendors for use in processing food for sale are not eligible for exemption.

COT/CD206BK (Rev. 8/04)

1

1 2

2