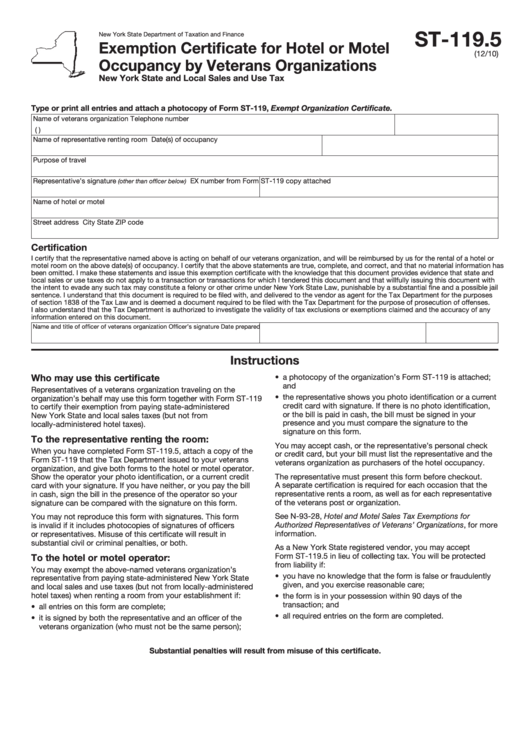

ST-119.5

New York State Department of Taxation and Finance

Exemption Certificate for Hotel or Motel

(12/10)

Occupancy by Veterans Organizations

New York State and Local Sales and Use Tax

Type or print all entries and attach a photocopy of Form ST-119, Exempt Organization Certificate.

Name of veterans organization

Telephone number

(

)

Name of representative renting room

Date(s) of occupancy

Purpose of travel

Representative’s signature

EX number from Form ST-119 copy attached

(other than officer below)

Name of hotel or motel

Street address

City

State

ZIP code

Certification

I certify that the representative named above is acting on behalf of our veterans organization, and will be reimbursed by us for the rental of a hotel or

motel room on the above date(s) of occupancy. I certify that the above statements are true, complete, and correct, and that no material information has

been omitted. I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and

local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with

the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail

sentence. I understand that this document is required to be filed with, and delivered to the vendor as agent for the Tax Department for the purposes

of section 1838 of the Tax Law and is deemed a document required to be filed with the Tax Department for the purpose of prosecution of offenses.

I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any

information entered on this document.

Name and title of officer of veterans organization

Officer’s signature

Date prepared

Instructions

Who may use this certificate

• a photocopy of the organization’s Form ST-119 is attached;

and

Representatives of a veterans organization traveling on the

• the representative shows you photo identification or a current

organization’s behalf may use this form together with Form ST-119

credit card with signature. If there is no photo identification,

to certify their exemption from paying state-administered

or the bill is paid in cash, the bill must be signed in your

New York State and local sales taxes (but not from

presence and you must compare the signature to the

locally-administered hotel taxes).

signature on this form.

To the representative renting the room:

You may accept cash, or the representative’s personal check

When you have completed Form ST-119.5, attach a copy of the

or credit card, but your bill must list the representative and the

Form ST-119 that the Tax Department issued to your veterans

veterans organization as purchasers of the hotel occupancy.

organization, and give both forms to the hotel or motel operator.

The representative must present this form before checkout.

Show the operator your photo identification, or a current credit

A separate certification is required for each occasion that the

card with your signature. If you have neither, or you pay the bill

representative rents a room, as well as for each representative

in cash, sign the bill in the presence of the operator so your

signature can be compared with the signature on this form.

of the veterans post or organization.

See N-93-28, Hotel and Motel Sales Tax Exemptions for

You may not reproduce this form with signatures. This form

Authorized Representatives of Veterans’ Organizations, for more

is invalid if it includes photocopies of signatures of officers

information.

or representatives. Misuse of this certificate will result in

substantial civil or criminal penalties, or both.

As a New York State registered vendor, you may accept

To the hotel or motel operator:

Form ST-119.5 in lieu of collecting tax. You will be protected

from liability if:

You may exempt the above-named veterans organization’s

• you have no knowledge that the form is false or fraudulently

representative from paying state-administered New York State

given, and you exercise reasonable care;

and local sales and use taxes (but not from locally-administered

hotel taxes) when renting a room from your establishment if:

• the form is in your possession within 90 days of the

transaction; and

• all entries on this form are complete;

• all required entries on the form are completed.

• it is signed by both the representative and an officer of the

veterans organization (who must not be the same person);

Substantial penalties will result from misuse of this certificate.

1

1 2

2