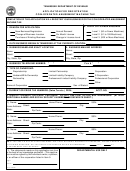

Schedule 2 (Form Rv-F1302101) - Addendum For Compliance Page 2

ADVERTISEMENT

INSTRUCTIONS FOR SCHEDULE 2

ADDENDUM FOR COMPLIANCE

1.

Indicate Tennessee business activities by fuel type. Specify other fuel in the column provided.

2.

Check blocks relating to movement of your product, or if a Transporter, check mode of Transportation.

3.

Includes International Registration Plan (IRP) vehicles that are proportionally licensed in Tennessee.

4.

Indicate source of undyed diesel used in company vehicles. Undyed diesel fuel is diesel fuel not dyed under United

States Environmental Protection Agency rules for high sulfur diesel fuel, nor not dyed under Internal Revenue

Service rules for low sulfur fuel.

5.

List all bulk plant locations by city and list all tank capacities by fuel type. Identifying numbers of storage tanks are

required per Underground Storage permit number(s) or Air Pollution Control permit number(s) registered with any

city or county agency, or with the Department of Environment & Conservation. If a tank is not registered with any

city, county, or state agency, then intercompany identification numbers will be accepted. Attach separate sheet(s)

of paper to include all tanks at every location.

6.

Check all account types that apply to sales of fuels other than gasoline.

7.

Indicate type of sale to governmental agencies holding valid exemption permits issued by the Tennessee

Department of Revenue.

8.

Include Internal Revenue Service information, if applicable.

9.

Indicate eight digit control numbers issued by the IRS for terminal facilities under Internal Revenue Code Section

4081 and regulations thereunder. Location refers to the actual city and state site of each facility.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2