Form Rv-F1300501 - Instructions For Completing Application For Registration

ADVERTISEMENT

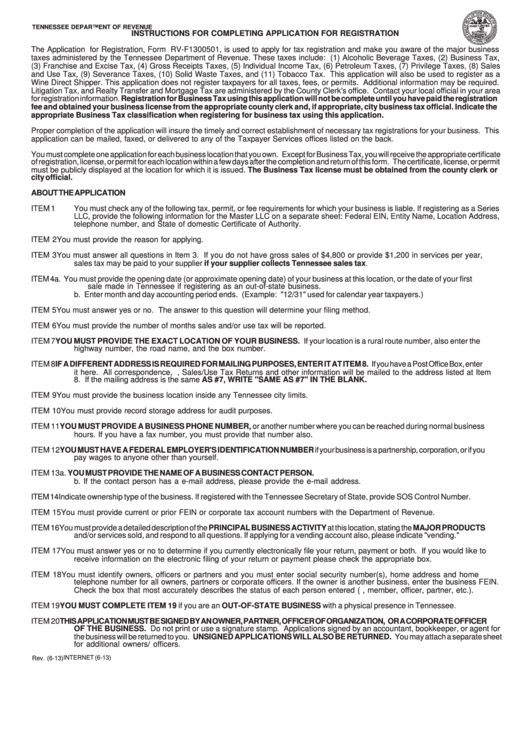

TENNESSEE DEPARTMENT OF REVENUE

INSTRUCTIONS FOR COMPLETING APPLICATION FOR REGISTRATION

The Application for Registration, Form RV-F1300501, is used to apply for tax registration and make you aware of the major business

taxes administered by the Tennessee Department of Revenue. These taxes include: (1) Alcoholic Beverage Taxes, (2) Business Tax,

(3) Franchise and Excise Tax, (4) Gross Receipts Taxes, (5) Individual Income Tax, (6) Petroleum Taxes, (7) Privilege Taxes, (8) Sales

and Use Tax, (9) Severance Taxes, (10) Solid Waste Taxes, and (11) Tobacco Tax. This application will also be used to register as a

Wine Direct Shipper. This application does not register taxpayers for all taxes, fees, or permits. Additional information may be required.

Litigation Tax, and Realty Transfer and Mortgage Tax are administered by the County Clerk's office. Contact your local official in your area

for registration information. Registration for Business Tax using this application will not be complete until you have paid the registration

fee and obtained your business license from the appropriate county clerk and, if appropriate, city business tax official. Indicate the

appropriate Business Tax classification when registering for business tax using this application.

Proper completion of the application will insure the timely and correct establishment of necessary tax registrations for your business. This

application can be mailed, faxed, or delivered to any of the Taxpayer Services offices listed on the back.

You must complete one application for each business location that you own. Except for Business Tax, you will receive the appropriate certificate

of registration, license, or permit for each location within a few days after the completion and return of this form. The certificate, license, or permit

must be publicly displayed at the location for which it is issued. The Business Tax license must be obtained from the county clerk or

city official.

ABOUT THE APPLICATION

You must check any of the following tax, permit, or fee requirements for which your business is liable. If registering as a Series

ITEM 1

LLC, provide the following information for the Master LLC on a separate sheet: Federal EIN, Entity Name, Location Address,

telephone number, and State of domestic Certificate of Authority.

ITEM 2

You must provide the reason for applying.

ITEM 3

You must answer all questions in Item 3. If you do not have gross sales of $4,800 or provide $1,200 in services per year,

sales tax may be paid to your supplier if your supplier collects Tennessee sales tax.

ITEM 4

a. You must provide the opening date (or approximate opening date) of your business at this location, or the date of your first

sale made in Tennessee if registering as an out-of-state business.

b. Enter month and day accounting period ends. (Example: "12/31" used for calendar year taxpayers.)

ITEM 5

You must answer yes or no. The answer to this question will determine your filing method.

ITEM 6

You must provide the number of months sales and/or use tax will be reported.

ITEM 7

YOU MUST PROVIDE THE EXACT LOCATION OF YOUR BUSINESS. If your location is a rural route number, also enter the

highway number, the road name, and the box number.

ITEM 8

IF A DIFFERENT ADDRESS IS REQUIRED FOR MAILING PURPOSES, ENTER IT AT ITEM 8. If you have a Post Office Box, enter

it here. All correspondence, i.e., Sales/Use Tax Returns and other information will be mailed to the address listed at Item

8. If the mailing address is the same AS #7, WRITE "SAME AS #7" IN THE BLANK.

ITEM 9

You must provide the business location inside any Tennessee city limits.

ITEM 10

You must provide record storage address for audit purposes.

ITEM 11

YOU MUST PROVIDE A BUSINESS PHONE NUMBER, or another number where you can be reached during normal business

hours. If you have a fax number, you must provide that number also.

ITEM 12

YOU MUST HAVE A FEDERAL EMPLOYER'S IDENTIFICATION NUMBER if your business is a partnership, corporation, or if you

pay wages to anyone other than yourself.

ITEM 13

a. YOU MUST PROVIDE THE NAME OF A BUSINESS CONTACT PERSON.

b. If the contact person has a e-mail address, please provide the e-mail address.

ITEM 14

Indicate ownership type of the business. If registered with the Tennessee Secretary of State, provide SOS Control Number.

ITEM 15

You must provide current or prior FEIN or corporate tax account numbers with the Department of Revenue.

ITEM 16

You must provide a detailed description of the PRINCIPAL BUSINESS ACTIVITY at this location, stating the MAJOR PRODUCTS

and/or services sold, and respond to all questions. If applying for a vending account also, please indicate "vending."

ITEM 17

You must answer yes or no to determine if you currently electronically file your return, payment or both. If you would like to

receive information on the electronic filing of your return or payment please check the appropriate box.

ITEM 18

You must identify owners, officers or partners and you must enter social security number(s), home address and home

telephone number for all owners, partners or corporate officers. If the owner is another business, enter the business FEIN.

Check the box that most accurately describes the status of each person entered (i.e., member, officer, partner, etc.).

ITEM 19

YOU MUST COMPLETE ITEM 19 if you are an OUT-OF-STATE BUSINESS with a physical presence in Tennessee.

ITEM 20

THIS APPLICATION MUST BE SIGNED BY AN OWNER, PARTNER, OFFICER OF ORGANIZATION, OR A CORPORATE OFFICER

OF THE BUSINESS. Do not print or use a signature stamp. Applications signed by an accountant, bookkeeper, or agent for

the business will be returned to you. UNSIGNED APPLICATIONS WILL ALSO BE RETURNED. You may attach a separate sheet

for additional owners/ officers.

INTERNET (6-13)

Rev. (6-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2