Instructions For Form 140 Schedule A - 2013

ADVERTISEMENT

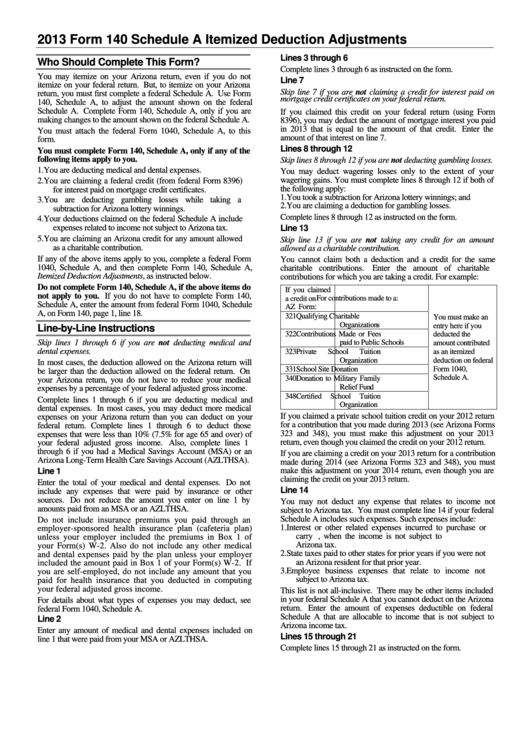

2013 Form 140 Schedule A Itemized Deduction Adjustments

Lines 3 through 6

Who Should Complete This Form?

Complete lines 3 through 6 as instructed on the form.

You may itemize on your Arizona return, even if you do not

Line 7

itemize on your federal return. But, to itemize on your Arizona

Skip line 7 if you are not claiming a credit for interest paid on

return, you must first complete a federal Schedule A. Use Form

mortgage credit certificates on your federal return.

140, Schedule A, to adjust the amount shown on the federal

Schedule A. Complete Form 140, Schedule A, only if you are

If you claimed this credit on your federal return (using Form

making changes to the amount shown on the federal Schedule A.

8396), you may deduct the amount of mortgage interest you paid

in 2013 that is equal to the amount of that credit. Enter the

You must attach the federal Form 1040, Schedule A, to this

amount of that interest on line 7.

form.

Lines 8 through 12

You must complete Form 140, Schedule A, only if any of the

following items apply to you.

Skip lines 8 through 12 if you are not deducting gambling losses.

1.

You are deducting medical and dental expenses.

You may deduct wagering losses only to the extent of your

wagering gains. You must complete lines 8 through 12 if both of

2.

You are claiming a federal credit (from federal Form 8396)

the following apply:

for interest paid on mortgage credit certificates.

1.

You took a subtraction for Arizona lottery winnings; and

3.

You are deducting gambling losses while taking a

2.

You are claiming a deduction for gambling losses.

subtraction for Arizona lottery winnings.

Complete lines 8 through 12 as instructed on the form.

4.

Your deductions claimed on the federal Schedule A include

expenses related to income not subject to Arizona tax.

Line 13

5.

You are claiming an Arizona credit for any amount allowed

Skip line 13 if you are not taking any credit for an amount

as a charitable contribution.

allowed as a charitable contribution.

If any of the above items apply to you, complete a federal Form

You cannot claim both a deduction and a credit for the same

1040, Schedule A, and then complete Form 140, Schedule A,

charitable contributions.

Enter the amount of charitable

Itemized Deduction Adjustments, as instructed below.

contributions for which you are taking a credit. For example:

Do not complete Form 140, Schedule A, if the above items do

If you claimed

not apply to you. If you do not have to complete Form 140,

a credit on

For contributions made to a:

Schedule A, enter the amount from federal Form 1040, Schedule

AZ Form:

A, on Form 140, page 1, line 18.

321

Qualifying Charitable

You must make an

Organizations

entry here if you

Line-by-Line Instructions

322

Contributions Made or Fees

deducted the

Skip lines 1 through 6 if you are not deducting medical and

paid to Public Schools

amount contributed

dental expenses.

323

Private

School

Tuition

as an itemized

Organization

deduction on federal

In most cases, the deduction allowed on the Arizona return will

Form 1040,

331

School Site Donation

be larger than the deduction allowed on the federal return. On

Schedule A.

340

Donation to Military Family

your Arizona return, you do not have to reduce your medical

Relief Fund

expenses by a percentage of your federal adjusted gross income.

348

Certified

School

Tuition

Complete lines 1 through 6 if you are deducting medical and

Organization

dental expenses. In most cases, you may deduct more medical

If you claimed a private school tuition credit on your 2012 return

expenses on your Arizona return than you can deduct on your

for a contribution that you made during 2013 (see Arizona Forms

federal return. Complete lines 1 through 6 to deduct those

323 and 348), you must make this adjustment on your 2013

expenses that were less than 10% (7.5% for age 65 and over) of

return, even though you claimed the credit on your 2012 return.

your federal adjusted gross income. Also, complete lines 1

through 6 if you had a Medical Savings Account (MSA) or an

If you are claiming a credit on your 2013 return for a contribution

Arizona Long-Term Health Care Savings Account (AZLTHSA).

made during 2014 (see Arizona Forms 323 and 348), you must

make this adjustment on your 2014 return, even though you are

Line 1

claiming the credit on your 2013 return.

Enter the total of your medical and dental expenses. Do not

Line 14

include any expenses that were paid by insurance or other

sources. Do not reduce the amount you enter on line 1 by

You may not deduct any expense that relates to income not

amounts paid from an MSA or an AZLTHSA.

subject to Arizona tax. You must complete line 14 if your federal

Schedule A includes such expenses. Such expenses include:

Do not include insurance premiums you paid through an

1.

Interest or other related expenses incurred to purchase or

employer-sponsored health insurance plan (cafeteria plan)

carry U.S. obligations, when the income is not subject to

unless your employer included the premiums in Box 1 of

Arizona tax.

your Form(s) W-2. Also do not include any other medical

2.

State taxes paid to other states for prior years if you were not

and dental expenses paid by the plan unless your employer

an Arizona resident for that prior year.

included the amount paid in Box 1 of your Form(s) W-2. If

3.

Employee business expenses that relate to income not

you are self-employed, do not include any amount that you

subject to Arizona tax.

paid for health insurance that you deducted in computing

your federal adjusted gross income.

This list is not all-inclusive. There may be other items included

in your federal Schedule A that you cannot deduct on the Arizona

For details about what types of expenses you may deduct, see

return. Enter the amount of expenses deductible on federal

federal Form 1040, Schedule A.

Schedule A that are allocable to income that is not subject to

Line 2

Arizona income tax.

Enter any amount of medical and dental expenses included on

Lines 15 through 21

line 1 that were paid from your MSA or AZLTHSA.

Complete lines 15 through 21 as instructed on the form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1