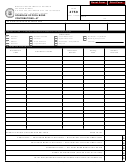

INSTRUCTIONS FOR FORM 4759,

SCHEDULE OF POOL BOND CONTRIBUTIONS

This schedule is to be used when remitting distributor pool bond contributions.

Include this schedule with your Form 572, Supplier’s Monthly Tax Report, or Form 4757, Distributor’s Monthly Tax Report, for the month

in which the pool bond contribution is due. Round to whole gallons and dollars.

General Information:

Complete each line on the top portion of the schedule. Provide all requested information for supplier. Complete a separate schedule

for each product type.

If you have questions or need assistance in completing this form, please call (573) 751-2611 or e-mail excise@dor.mo.gov. You may

also access the Department’s web site at to obtain this form.

Pool Bond Money Collected

1. Provide the distributor’s FEIN and name, document number, date of sale, and number of gallons invoiced for each participating

distributor.

2. Enter total gallons subject to pool bond collection. Only gallons from Supplier Schedule 5A, 5B, 5F, 5G, 5H, and 6 (clear kerosene

and jet fuel only) or Distributor Schedule 1C, 2A (gasoline, gasohol, aviation gasoline, diesel fuel, kerosene, dyed diesel fuel, and

dyed kerosene), 2B, and 5W and 10A (alcohol, bio-diesel–B100, and soy oil) are subject to pool bond contributions.

3. Multiply number of gallons of motor fuel times (x) $.0024 or the number of gallons of aviation gasoline times (x) $.0013 to arrive at

the pool bond contribution.

4. Enter total of all pool bond contributions on Line 29 of the Form 572, Supplier’s Monthly Tax Report or Line 33 of Form 4757,

Distributor’s Monthly Tax Report.

MO 860-2838 (02-2011)

1

1 2

2