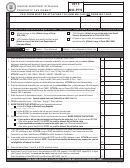

Select One

r

r

r

r

r

C Corporation

Financial Institution

Individual

Individual Filing a Joint Return

Limited Liability Company (LLC)

r

r

r

r

S Corporation

Partnership

Sole Proprietor

Other __________________________________________________

If the taxpayer is an individual filing a joint return, list the primary and secondary names and social security numbers

below. If the taxpayer is a Partnership, S Corporation, or other entity with a flow through tax treatment, identify the names, social

security numbers, and proportionate share of ownership of each beneficiary, partner, or shareholder on the last day of the tax

period. Aggregate proportionate shares or percent of total ownership must be less than 100%. Attach a separate sheet if necessary.

Federal Employer I.D. Number, Missouri Tax

Name(s)

% Ownership Year End

I.D. Number, or Social Security Number

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

%

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I certify that I am an

authorized representative of the Assignee and as such am authorized to make the statement of affirmation contained herein.

Assignee Signature

Title

Print Name

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Subscribed and sworn before me, this

Embosser or black ink rubber stamp seal

day of

year

State

County (or City of St. Louis)

My Commission Expires (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Notary Public Signature

Notary Public Name (Typed or Printed)

Mailing and Contact Information

Mail Form MO-TF to the appropriate address below with regards to the program for which tax credits were originally issued.

Missouri Department of Revenue

301 W High Street, Room 330

Attention: Personal Tax

Jefferson City, MO 65105

Phone: (573) 751-3055

E-mail:

income@dor.mo.gov

• Alternative Fuel Infrastructure

• Missouri Works Tax Credit

• Brownfield Remediation Tax Credit

• Neighborhood Preservation Act

• Business Facility Tax Credit

• New Enterprise Creation Act or Prolog Ventures

• Certified Capital Companies (CAPCO) Tax Credit

• Rebuilding Communities Tax Credit

• Champion for Children Tax Credit

• Seed Capital Tax Credit

• Charcoal Producers Tax Credit

• Small Business Incubator Tax Credit*

• Community Bank or Community Development Tax Credit

• Small Business Investment Capital Tax Credit

• Development Tax Credit

• Special Needs Adoption Tax Credit*

• Dry Fire Hydrant Tax Credit

• Sporting Event Tax Credit

• Enhanced Enterprise Zone Tax Credit*

• Sporting Event Contribution Tax Credit

• Historic Preservation Tax Credit - Issued after 08/28/1998

• Transportation Development Tax Credit

• Missouri Quality Jobs

• Wood Energy Tax Credit

* Must be sold for at least 75% of transferred credit value

Form MO-TF (Revised 12-2013)

Missouri Housing Development Commission

Attn: Gus Metz

Visit

for additional information.

3435 Broadway

Kansas City, MO 64111

Phone: (816) 759-6878

• Affordable Housing Assistance (AHAP)

1

1 2

2