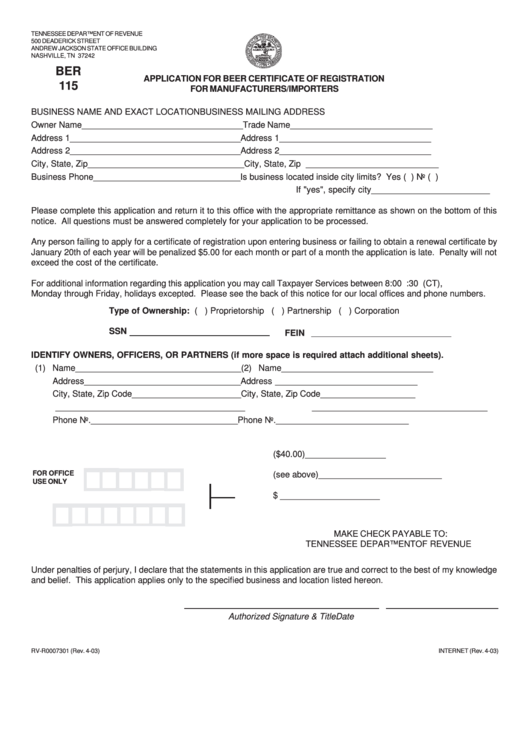

TENNESSEE DEPARTMENT OF REVENUE

500 DEADERICK STREET

ANDREW JACKSON STATE OFFICE BUILDING

NASHVILLE, TN 37242

BER

APPLICATION FOR BEER CERTIFICATE OF REGISTRATION

115

FOR MANUFACTURERS/IMPORTERS

BUSINESS NAME AND EXACT LOCATION

BUSINESS MAILING ADDRESS

Owner Name __________________________________

Trade Name ______________________________

Address 1 ____________________________________

Address 1 ________________________________

Address 2 ____________________________________

Address 2 ________________________________

City, State, Zip _________________________________

City, State, Zip ____________________________

Business Phone _______________________________

Is business located inside city limits? Yes ( ) No ( )

If "yes", specify city _________________________

Please complete this application and return it to this office with the appropriate remittance as shown on the bottom of this

notice. All questions must be answered completely for your application to be processed.

Any person failing to apply for a certificate of registration upon entering business or failing to obtain a renewal certificate by

January 20th of each year will be penalized $5.00 for each month or part of a month the application is late. Penalty will not

exceed the cost of the certificate.

For additional information regarding this application you may call Taxpayer Services between 8:00 a.m. and 4:30 p.m. (CT),

Monday through Friday, holidays excepted. Please see the back of this notice for our local offices and phone numbers.

Type of Ownership: ( ) Proprietorship ( ) Partnership ( ) Corporation

SSN

FEIN

IDENTIFY OWNERS, OFFICERS, OR PARTNERS (if more space is required attach additional sheets).

(1) Name ___________________________________

(2) Name ________________________________

Address _________________________________

Address ______________________________

City, State, Zip Code _______________________

City, State, Zip Code ____________________

________________________________________

_____________________________________

Phone No. _______________________________

Phone No. ____________________________

1. Manufacturer/Importer ($40.00) _________________

FOR OFFICE

2. Penalty (see above) __________________________

USE ONLY

3. Total amount of payment $ _____________________

MAKE CHECK PAYABLE TO:

TENNESSEE DEPARTMENTOF REVENUE

Under penalties of perjury, I declare that the statements in this application are true and correct to the best of my knowledge

and belief. This application applies only to the specified business and location listed hereon.

Authorized Signature & Title

Date

RV-R0007301 (Rev. 4-03)

INTERNET (Rev. 4-03)

1

1 2

2