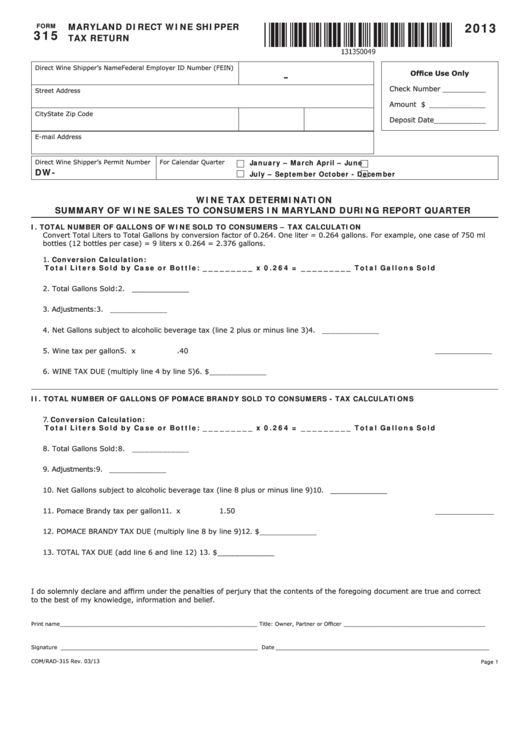

2013

MARYLAND DIRECT WINE SHIPPER

FORM

315

TAX RETURN

Direct Wine Shipper’s Name

Federal Employer ID Number (FEIN)

-

Office Use Only

Check Number __________

Street Address

Amount $ _____________

City

State

Zip Code

Deposit Date____________

E-mail Address

Direct Wine Shipper’s Permit Number

For Calendar Quarter

January – March

April – June

DW-

July – September

October - December

WINE TAX DETERMINATION

SUMMARY OF WINE SALES TO CONSUMERS IN MARYLAND DURING REPORT QUARTER

I. TOTAL NUMBER OF GALLONS OF WINE SOLD TO CONSUMERS – TAX CALCULATION

Convert Total Liters to Total Gallons by conversion factor of 0.264. One liter = 0.264 gallons. For example, one case of 750 ml

bottles (12 bottles per case) = 9 liters x 0.264 = 2.376 gallons.

1.

Conversion Calculation:

Total Liters Sold by Case or Bottle: _________ x 0.264 = _________ Total Gallons Sold

2.

Total Gallons Sold: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

_____________

3.

Adjustments: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

_____________

4.

Net Gallons subject to alcoholic beverage tax (line 2 plus or minus line 3) . . . . . . . . . . . . . . . . . . . . 4.

_____________

5.

Wine tax per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

x

.40

6.

WINE TAX DUE (multiply line 4 by line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. $ _____________

II. TOTAL NUMBER OF GALLONS OF POMACE BRANDY SOLD TO CONSUMERS - TAX CALCULATIONS

7.

Conversion Calculation:

Total Liters Sold by Case or Bottle: _________ x 0.264 = _________ Total Gallons Sold

8.

Total Gallons Sold: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

_____________

9.

Adjustments: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

_____________

10. Net Gallons subject to alcoholic beverage tax (line 8 plus or minus line 9) . . . . . . . . . . . . . . . . . . . 10.

_____________

11. Pomace Brandy tax per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

x

1.50

12. POMACE BRANDY TAX DUE (multiply line 8 by line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. $ _____________

13. TOTAL TAX DUE (add line 6 and line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. $ _____________

I do solemnly declare and affirm under the penalties of perjury that the contents of the foregoing document are true and correct

to the best of my knowledge, information and belief.

Print name ____________________________________________________________

Title: Owner, Partner or Officer ___________________________________________

Signature ____________________________________________________________

Date _________________________________________________________________

COM/RAD-315

Rev. 03/13

Page 1

1

1 2

2 3

3