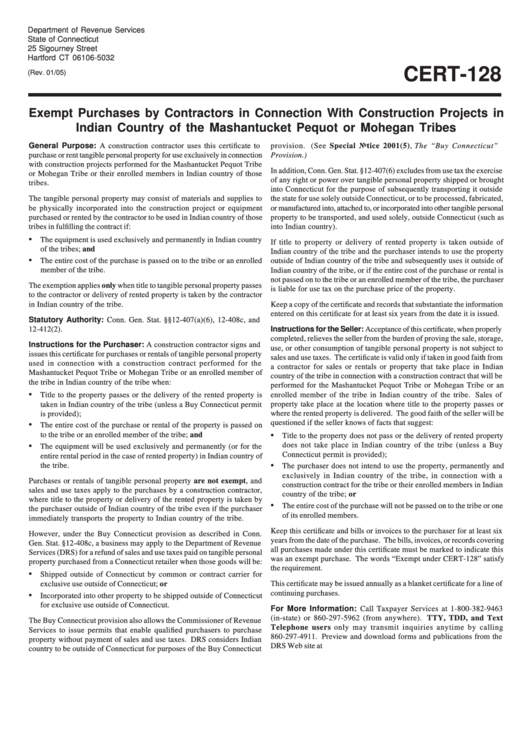

Form Cert-128 - Exempt Purchases By Contractors In Connection With Construction Projects In Indian Country Of The Mashantucket Pequot Or Mohegan Tribes

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-128

(Rev. 01/05)

Exempt Purchases by Contractors in Connection With Construction Projects in

Indian Country of the Mashantucket Pequot or Mohegan Tribes

General Purpose: A construction contractor uses this certificate to

provision. (See Special Notice 2001(5), The “Buy Connecticut”

purchase or rent tangible personal property for use exclusively in connection

Provision.)

with construction projects performed for the Mashantucket Pequot Tribe

In addition, Conn. Gen. Stat. §12-407(6) excludes from use tax the exercise

or Mohegan Tribe or their enrolled members in Indian country of those

of any right or power over tangible personal property shipped or brought

tribes.

into Connecticut for the purpose of subsequently transporting it outside

The tangible personal property may consist of materials and supplies to

the state for use solely outside Connecticut, or to be processed, fabricated,

be physically incorporated into the construction project or equipment

or manufactured into, attached to, or incorporated into other tangible personal

purchased or rented by the contractor to be used in Indian country of those

property to be transported, and used solely, outside Connecticut (such as

tribes in fulfilling the contract if:

into Indian country).

•

The equipment is used exclusively and permanently in Indian country

If title to property or delivery of rented property is taken outside of

of the tribes; and

Indian country of the tribe and the purchaser intends to use the property

•

The entire cost of the purchase is passed on to the tribe or an enrolled

outside of Indian country of the tribe and subsequently uses it outside of

member of the tribe.

Indian country of the tribe, or if the entire cost of the purchase or rental is

not passed on to the tribe or an enrolled member of the tribe, the purchaser

The exemption applies only when title to tangible personal property passes

is liable for use tax on the purchase price of the property.

to the contractor or delivery of rented property is taken by the contractor

in Indian country of the tribe.

Keep a copy of the certificate and records that substantiate the information

entered on this certificate for at least six years from the date it is issued.

Statutory Authority: Conn. Gen. Stat. §§12-407(a)(6), 12-408c, and

12-412(2).

Instructions for the Seller: Acceptance of this certificate, when properly

completed, relieves the seller from the burden of proving the sale, storage,

Instructions for the Purchaser: A construction contractor signs and

use, or other consumption of tangible personal property is not subject to

issues this certificate for purchases or rentals of tangible personal property

sales and use taxes. The certificate is valid only if taken in good faith from

used in connection with a construction contract performed for the

a contractor for sales or rentals or property that take place in Indian

Mashantucket Pequot Tribe or Mohegan Tribe or an enrolled member of

country of the tribe in connection with a construction contract that will be

the tribe in Indian country of the tribe when:

performed for the Mashantucket Pequot Tribe or Mohegan Tribe or an

•

enrolled member of the tribe in Indian country of the tribe. Sales of

Title to the property passes or the delivery of the rented property is

property take place at the location where title to the property passes or

taken in Indian country of the tribe (unless a Buy Connecticut permit

where the rented property is delivered. The good faith of the seller will be

is provided);

questioned if the seller knows of facts that suggest:

•

The entire cost of the purchase or rental of the property is passed on

to the tribe or an enrolled member of the tribe; and

•

Title to the property does not pass or the delivery of rented property

•

does not take place in Indian country of the tribe (unless a Buy

The equipment will be used exclusively and permanently (or for the

Connecticut permit is provided);

entire rental period in the case of rented property) in Indian country of

•

the tribe.

The purchaser does not intend to use the property, permanently and

exclusively in Indian country of the tribe, in connection with a

Purchases or rentals of tangible personal property are not exempt, and

construction contract for the tribe or their enrolled members in Indian

sales and use taxes apply to the purchases by a construction contractor,

country of the tribe; or

where title to the property or delivery of the rented property is taken by

•

The entire cost of the purchase will not be passed on to the tribe or one

the purchaser outside of Indian country of the tribe even if the purchaser

of its enrolled members.

immediately transports the property to Indian country of the tribe.

Keep this certificate and bills or invoices to the purchaser for at least six

However, under the Buy Connecticut provision as described in Conn.

years from the date of the purchase. The bills, invoices, or records covering

Gen. Stat. §12-408c, a business may apply to the Department of Revenue

all purchases made under this certificate must be marked to indicate this

Services (DRS) for a refund of sales and use taxes paid on tangible personal

was an exempt purchase. The words “Exempt under CERT-128” satisfy

property purchased from a Connecticut retailer when those goods will be:

the requirement.

•

Shipped outside of Connecticut by common or contract carrier for

This certificate may be issued annually as a blanket certificate for a line of

exclusive use outside of Connecticut; or

continuing purchases.

•

Incorporated into other property to be shipped outside of Connecticut

for exclusive use outside of Connecticut.

For More Information: Call Taxpayer Services at 1-800-382-9463

(in-state) or 860-297-5962 (from anywhere). TTY, TDD, and Text

The Buy Connecticut provision also allows the Commissioner of Revenue

Telephone users only may transmit inquiries anytime by calling

Services to issue permits that enable qualified purchasers to purchase

860-297-4911. Preview and download forms and publications from the

property without payment of sales and use taxes. DRS considers Indian

DRS Web site at

country to be outside of Connecticut for purposes of the Buy Connecticut

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2