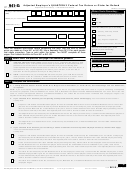

Name (not your trade name)

Employer identification number (EIN)

Calendar Year (YYYY)

Part 3:

Enter the corrections for the calendar year you are correcting. If any line does not apply, leave it blank.

Column 2

Column 3

Column 4

Column 1

Total corrected

Amount originally reported

Difference (If this amount

=

—

amount (for ALL

or as previously corrected

is a negative number, use

employees)

(for ALL employees)

a minus sign.)

Tax correction

6.

Total wages subject to social

=

—

× .124* =

.

.

.

.

security tax (Form 943, line 2)

*If you are correcting a 2011 or 2012 return, use .104. If you are correcting

your employer share only, use .062. See instructions.

7.

Total wages subject to

=

—

× .029* =

.

.

.

.

Medicare tax (Form 943, line 4)

*If you are correcting your employer share only, use .0145. See instructions.

8.

Total wages subject to Additional

=

—

× .009 =

.

.

.

.

Medicare Tax withholding (Form 943,

line 6; only for years beginning after

December 31, 2012)

9.

Federal income tax withheld

=

Copy Column

—

.

.

.

.

(Form 943, line 8 (line 6 for years

3 here

▶

ending before January 1, 2013))

*Complete lines 10a

10a. Number of qualified employees paid

=

—

and 10b only for

exempt wages April 1 – December

corrections to the

2010 Form 943.

31, 2010 (Form 943, line 7a)*

10b. Exempt wages paid to qualified

=

—

.

.

.

× .062 =

.

employees April 1 – December 31,

2010 (Form 943, line 7b)*

11.

Tax adjustments (Form 943,

=

See

—

.

.

.

.

line 10 (line 8 for years ending

instructions

before January 1, 2013))

Special addition to wages for

=

12.

See

—

.

.

.

.

instructions

federal income tax

Special addition to wages for

13.

=

See

—

.

.

.

.

instructions

social security taxes

Special addition to wages for

=

14.

See

—

.

.

.

.

instructions

Medicare taxes

Special addition to wages for

15.

=

See

—

.

.

.

.

instructions

Additional Medicare Tax

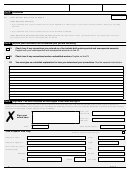

16.

Subtotal: Combine the amounts in lines 6–15 of Column 4 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Advance earned income credit (EIC)

17.

payments made to employees (Form

=

See

—

.

.

.

.

instructions

943, line 10; only for years ending before

January 1, 2011)

18a. COBRA premium assistance payments

=

—

See

(Form 943, line 13a for calendar years

.

.

.

.

instructions

2010 and 2013 (line 11a for calendar

years 2011 and 2012))

18b. Number of individuals provided COBRA

=

—

premium assistance (Form 943, line 13b

for calendar years 2010 and 2013 (line

11b for calendar years 2011 and 2012))

18c. Number of qualified employees

*Complete lines 18c and

=

—

paid exempt wages March 19–31,

18d only for corrections

to the 2010 Form 943.

2010 (Form 943, line 13c)*

18d. Exempt wages paid to qualified

=

employees March 19–31, 2010

—

× .062 =

.

.

.

.

(Form 943, line 13d)*

19.

Total. Combine the amounts in lines 16–18d of Column 4. Continue to next page.

.

.

.

.

.

.

.

.

.

.

.

.

Next

▶

■

2

943-X

Page

Form

(Rev. 2-2014)

1

1 2

2 3

3 4

4