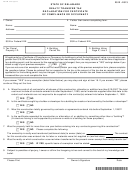

FORM 5401(8)CO

STATE OF DELAWARE

REALTY TRANSFER TAX

DECLARATION FOR CERTIFICATE

OF COMPLIANCE OR OCCUPANCY

Social Security or Federal EIN

Name of Owner

1.

(a) Was the Building Permit applied for solely for alteration to an existing building:

YES

NO

IF NO, GO TO ITEM #2.

(b) IF YES, enter the value, at the time of conveyance for realty tax purposes, of land and

$

improvements on which construction is intended:

2.

Enter amount of money paid or to be paid under any and all contracts which:

(a) pertain to all phases of the construction or alteration of, or addition to, the building

for which the Building Permit was sought; and

$

(b) were entered into after September 1, 1990. Include all purchases of supplies

after September 1, 1990 to the extent not required under contracts entered

into on or before September 1, 1990.

$

3.

(a) Subtract $10,000 from the amount entered in Item #2 and enter the results here:

(b) If Item #1 is answered “YES”, is the amount entered in Item #2 less then 50% of the

amount entered in Item #1(b)?

YES

NO

IF YES, YOU MAY STOP HERE AND SIGN BELOW.

(c) IF EITHER Item #l(a) or Item #3(b) is answered NO, multiply the amount entered

$

in Item #3a (.01) and enter results here:

(d) Have you previously paid a realty transfer tax on FORM 5401(8)BP relative to this

or other phases of the same construction?

YES

NO

$

IF YES, please attach copy of earlier FORM 5401(8)BP.

Enter amount paid with earlier FORM 5401(8)BP:

(e) Subtract amount entered on line 3(d) from amount entered on line 3(c)

$

and enter the difference here:

YOU MUST PAY THE AMOUNT ON LINE 3(e) TO THE STATE OF DELAWARE DIVISION OF REVENUE

PRIOR TO BEING ISSUED THE CERTIFICATE OF COMPLIANCE OR OCCUPANCY

NOTE: YOU MAY OWE AN ADDITIONAL AMOUNT TO THE MUNICIPALITY ISSUING THE BUILDING PERMIT.

4.

Subject to the penalties of perjury. I swear or affirm the foregoing is true and correct to the best of my knowledge and belief.

Owner’s Signature

Date

Please Print

Revised 01/28/13

*DF42613029999*

1

1 2

2