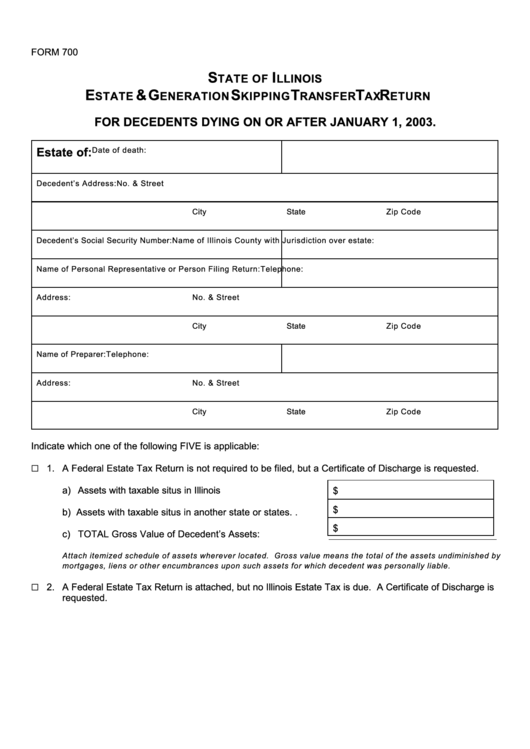

Form 700 - Estate & Generation Skipping Transfer Tax Return For Decedents Dying On Or After January 1, 2003

ADVERTISEMENT

FORM 700

S

I

TATE OF

LLINOIS

E

& G

S

T

T

R

STATE

ENERATION

KIPPING

RANSFER

AX

ETURN

FOR DECEDENTS DYING ON OR AFTER JANUARY 1, 2003.

Date of death:

Estate of:

Decedent’s Address:

No. & Street

City

State

Zip Code

Dece dent’s Social Security Num ber:

Nam e of Illinois County with Jurisdiction over estate:

Nam e of Personal Representative or Person Filing Return:

Telephone:

Address:

No. & Street

City

State

Zip Code

Nam e of Prepare r:

Telephone:

Address:

No. & Street

City

State

Zip Code

Indicate which one of the following FIVE is applicable:

G 1. A Federal Estate Tax Return is not required to be filed, but a Certificate of Discharge is requested.

a) Assets with taxable situs in Illinois . . . . . . . . . . . . . . .

$

$

b) Assets with taxable situs in another state or states . .

$

c) TOTAL Gross Value of Decedent’s Assets: . . . . . . . .

Attach itemized schedule of assets wherever located. Gross value means the total of the assets undiminished by

mortgages, liens or other encumbrances upon such assets for which decedent was personally liable.

G 2. A Federal Estate Tax Return is attached, but no Illinois Estate Tax is due. A Certificate of Discharge is

requested.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4