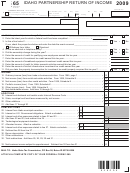

Page 2

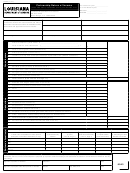

Schedule A — Cost of goods sold

1. Method of inventory valuation — cost

; lower of cost or market

;

1. Opening inventory*

$

LIFO

; other

. (If other, attach explanation.)

2. Purchases

$

2. Was the method of inventory valuation indicated above the same

method used for last year?

Yes

No

(If “No” attach explanation.)

Less: Cost of items withdrawn

3. If inventory is valued at lower of cost or market, print total cost

for personal use

$

$

$ _______________ and total market valuation $_______________ of

3. Cost of labor, supplies, etc.

$

those items valued at market.

4. Total of Lines 1, 2, and 3

$

4. If closing inventory was taken by physical count, print date inventory

5. Less: Closing inventory

$

was taken _______________. If not at end of year, attach an explana-

tion of how the end of the year count was determined.

6. Cost of goods sold. (Print here and on Line 2,

Page 1.)

$

5. If closing inventory was not taken by a physical count, attach an

explanation of how inventory items were counted or measured.

*If different from last year ’s closing inventor y, attach explanation.

Schedule B — Income from rents and royalties

1. Kind and location of property

2. Amount

3. Depreciation

4. Repairs

5. Other expenses

(Explain on Sch. G.)

(Explain on Sch. B-1.)

(Explain on Sch. B-1.)

1. Total

2. Net income (or loss) (Column 2 less the sum of Columns 3, 4, and 5. Print on Line 7, Page 1.)

$

Schedule B-1 — Explanation of Columns 4 and 5 of Schedule B

Column

Explanation

Amount

Column

Explanation

Amount

Schedule C — Explanation of interest and taxes (Lines 16 and 17, Page 1)

Explanation

Amount

Explanation

Amount

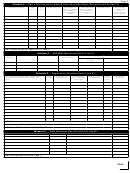

Schedule D — Gain from sale of capital assets (See instructions for Line 9.)

1. Description of property

2. Date

3. Date

4. Gross sales price

5. Depreciation al-

6. Cost or other basis

7. Expense of sale

8. Gain or loss

acquired

sold

lowed (or allowable)

and cost of improve-

(Column 4 plus

since acquisition or

ments subsequent

Column

Jan. 1, 1934 (Attach

to acquisition or Jan.

5, less the sum of

schedule.)

1, 1934

Columns 6 and 7)

Total (Transfer net gain to Line 9, Page 1.)

$

6044

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11