Form Mft-10a - Instructions For Completing Monthly Seller-User Tax Report

ADVERTISEMENT

MFT-10A

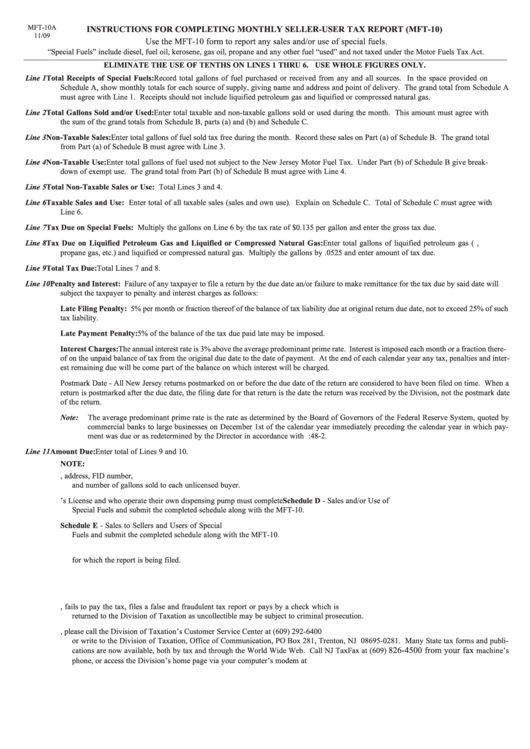

INSTRUCTIONS FOR COMPLETING MONTHLY SELLER-USER TAX REPORT (MFT-10)

11/09

Use the MFT-10 form to report any sales and/or use of special fuels.

“Special Fuels” include diesel, fuel oil, kerosene, gas oil, propane and any other fuel “used” and not taxed under the Motor Fuels Tax Act.

ELIMINATE THE USE OF TENTHS ON LINES 1 THRU 6. USE WHOLE FIGURES ONLY.

Line 1

Total Receipts of Special Fuels: Record total gallons of fuel purchased or received from any and all sources. In the space provided on

Schedule A, show monthly totals for each source of supply, giving name and address and point of delivery. The grand total from Schedule A

must agree with Line 1. Receipts should not include liquified petroleum gas and liquified or compressed natural gas.

Line 2

Total Gallons Sold and/or Used: Enter total taxable and non-taxable gallons sold or used during the month. This amount must agree with

the sum of the grand totals from Schedule B, parts (a) and (b) and Schedule C.

Line 3

Non-Taxable Sales: Enter total gallons of fuel sold tax free during the month. Record these sales on Part (a) of Schedule B. The grand total

from Part (a) of Schedule B must agree with Line 3.

Line 4

Non-Taxable Use: Enter total gallons of fuel used not subject to the New Jersey Motor Fuel Tax. Under Part (b) of Schedule B give break-

down of exempt use. The grand total from Part (b) of Schedule B must agree with Line 4.

Line 5

Total Non-Taxable Sales or Use: Total Lines 3 and 4.

Taxable Sales and Use: Enter total of all taxable sales (sales and own use). Explain on Schedule C. Total of Schedule C must agree with

Line 6

Line 6.

Line 7

Tax Due on Special Fuels: Multiply the gallons on Line 6 by the tax rate of $0.135 per gallon and enter the gross tax due.

Line 8

Tax Due on Liquified Petroleum Gas and Liquified or Compressed Natural Gas: Enter total gallons of liquified petroleum gas (i.e.,

propane gas, etc.) and liquified or compressed natural gas. Multiply the gallons by .0525 and enter amount of tax due.

Total Tax Due: Total Lines 7 and 8.

Line 9

Line 10

Penalty and Interest: Failure of any taxpayer to file a return by the due date an/or failure to make remittance for the tax due by said date will

subject the taxpayer to penalty and interest charges as follows:

Late Filing Penalty: 5% per month or fraction thereof of the balance of tax liability due at original return due date, not to exceed 25% of such

tax liability.

Late Payment Penalty: 5% of the balance of the tax due paid late may be imposed.

Interest Charges: The annual interest rate is 3% above the average predominant prime rate. Interest is imposed each month or a fraction there-

of on the unpaid balance of tax from the original due date to the date of payment. At the end of each calendar year any tax, penalties and inter-

est remaining due will be come part of the balance on which interest will be charged.

Postmark Date - All New Jersey returns postmarked on or before the due date of the return are considered to have been filed on time. When a

return is postmarked after the due date, the filing date for that return is the date the return was received by the Division, not the postmark date

of the return.

Note:

The average predominant prime rate is the rate as determined by the Board of Governors of the Federal Reserve System, quoted by

commercial banks to large businesses on December 1st of the calendar year immediately preceding the calendar year in which pay-

ment was due or as redetermined by the Director in accordance with N.J.S.A. 54:48-2.

Line 11

Amount Due: Enter total of Lines 9 and 10.

NOTE:

1. Any person who has sales to unlicensed buyers of special fuels must attach a rider to the MFT-10 stating the name, address, FID number,

and number of gallons sold to each unlicensed buyer.

2. All persons holding a Seller-User’s License and who operate their own dispensing pump must complete Schedule D - Sales and/or Use of

Special Fuels and submit the completed schedule along with the MFT-10.

3. Any person who has sales to other Sellers and Users of Special Fuels must complete Schedule E - Sales to Sellers and Users of Special

Fuels and submit the completed schedule along with the MFT-10.

4. This return and remittance must be filed with the New Jersey Division of Taxation on or before the 20th of the month following the month

for which the report is being filed.

5. An accurate record of meter readings must be maintained in your files to support the disbursements reported.

6. Seller/Users are required to maintain records of their activities. Please make a copy of the MFT-10 report for your files.

7. Any person who willfully fails to file a tax report, fails to pay the tax, files a false and fraudulent tax report or pays by a check which is

returned to the Division of Taxation as uncollectible may be subject to criminal prosecution.

8. If you have any questions regarding the MFT-10 report, please call the Division of Taxation’s Customer Service Center at (609) 292-6400

or write to the Division of Taxation, Office of Communication, PO Box 281, Trenton, NJ 08695-0281. Many State tax forms and publi-

826-4500 from your fax

cations are now available, both by tax and through the World Wide Web. Call NJ TaxFax at (609)

machine’s

phone, or access the Division’s home page via your computer’s modem at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1