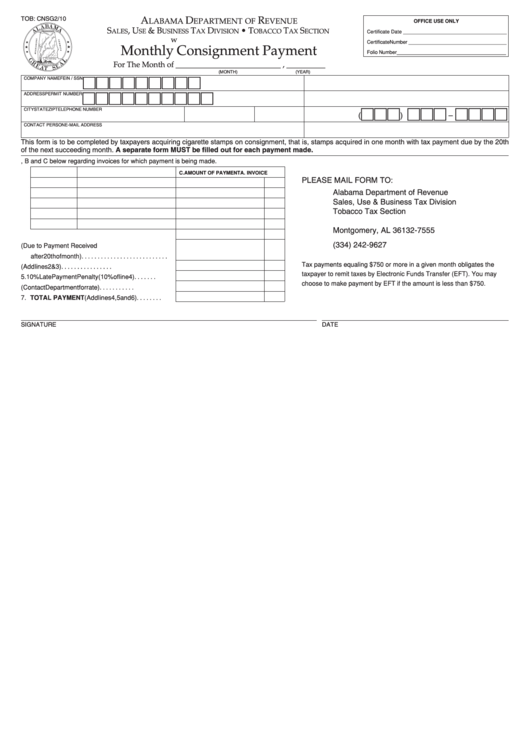

TOB: CNSG

2/10

A

D

R

LABAMA

EPARTMENT OF

EVENUE

OFFICE USE ONLY

S

, U

& B

T

D

• T

T

S

ALES

SE

USINESS

AX

IVISION

OBACCO

AX

ECTION

Certificate Date _____________________________________

Certificate Number ___________________________________

Reset

Monthly Consignment Payment

Folio Number_______________________________________

For The Month of ___________________________ , __________

(MONTH)

(YEAR)

COMPANY NAME

FEIN / SSN

ADDRESS

PERMIT NUMBER

CITY

STATE

ZIP

TELEPHONE NUMBER

(

)

–

CONTACT PERSON

E-MAIL ADDRESS

This form is to be completed by taxpayers acquiring cigarette stamps on consignment, that is, stamps acquired in one month with tax payment due by the 20th

of the next succeeding month. A separate form MUST be filled out for each payment made.

1. Complete A, B and C below regarding invoices for which payment is being made.

A. INVOICE DATE B.

INVOICE NUMBER

C.

AMOUNT OF PAYMENT

PLEASE MAIL FORM TO:

Alabama Department of Revenue

Sales, Use & Business Tax Division

Tobacco Tax Section

P.O. Box 327555

Montgomery, AL 36132-7555

2. Total of Invoices. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(334) 242-9627

3. Lost Discount (Due to Payment Received

after 20th of month). . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax payments equaling $750 or more in a given month obligates the

4. Total Tax Due (Add lines 2 & 3) . . . . . . . . . . . . . . . .

taxpayer to remit taxes by Electronic Funds Transfer (EFT). You may

5. 10% Late Payment Penalty (10% of line 4). . . . . . .

choose to make payment by EFT if the amount is less than $750.

6. Interest (Contact Department for rate) . . . . . . . . . . .

7. TOTAL PAYMENT(Add lines 4, 5 and 6) . . . . . . . .

SIGNATURE

DATE

1

1