EFO00242p4

Form 72 - Page 3

10-10-13

SPECIFIC INSTRUCTIONS

See Qualifying Wages on page 2 for additional information.

Form 72-S or your own schedule must be included with the

Instructions are for lines not fully explained on the form.

return to identify the specific new employees and qualifying

PART II. INCREASE IN NUMBER OF EMPLOYEES

wages reported on Part III, lines 1a and 1b. Information

Line 1. Determine the average number of employees during

submitted must include the employee's name, Social Security

the tax year by adding the number of qualifying employees

Number, date hired, date terminated, county of employment,

health care benefit coverage (single 80% or family 70%), total

reported for each month on your Idaho Employer Quarterly

Unemployment Insurance Tax Reports and dividing that amount

wages paid to the employee during the initial 12 months of

by the number of months of operation during the tax year.

employment, gross wages reported on Form 72, Part III, line 1a

and gross wages reported on Form 72, Part III, line 1b.

Line 2. Determine the average number of employees during

the three preceding tax years by dividing the total of the

Line 1a. Enter the total amount of qualifying wages for those

average number of qualifying employees reported on your Idaho

employees included in Part II, line 4 with an hourly wage rate

Employer Quarterly Unemployment Insurance Tax Reports for

of at least $12 per hour in a county with an unemployment rate

each preceding year by three. If your business existed for less

equal to or greater than 10%.

than three tax years, use the number of tax years in existence.

Line 1b. Enter the total amount of qualifying wages for those

Line 3. Determine the average number of employees during

employees included in Part II, line 4 with an hourly wage rate of

the preceding tax year by adding the number of qualifying

at least $15 per hour in a county with an unemployment rate less

employees reported for each month on your Idaho Employer

than 10%.

Quarterly Unemployment Insurance Tax Reports and dividing

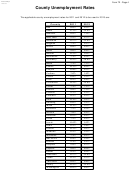

See page 4 for the county unemployment rates.

that amount by the number of months of operation during the

preceding tax year.

PART IV. CREDIT ALLOWED

Line 1. Enter the credit percentage associated with your Idaho

Line 4. No credit is allowed unless the number on this line

Department of Labor taxable wage rate. This will be either 2%,

equals or exceeds one. If it is more than one, the number is

4% or 6%.

rounded down to the nearest whole number.

Line 2. Enter amount on this line and on your Idaho return. If

PART III. QUALIFYING WAGES

you are filing Form 40, enter amount on line 48; Form 41, enter

For purposes of lines 1a and 1b, when identifying the qualifying

amount on line 55; Form 41S, enter amount on line 61; Form 43,

wages of new employees included on Part II, line 4, the new

enter amount on line 67; Form 65, enter amount on line 57; or

employees are those qualifying employees who were last hired

Form 66, enter amount on line 26.

by the employer.

1

1 2

2 3

3 4

4 5

5