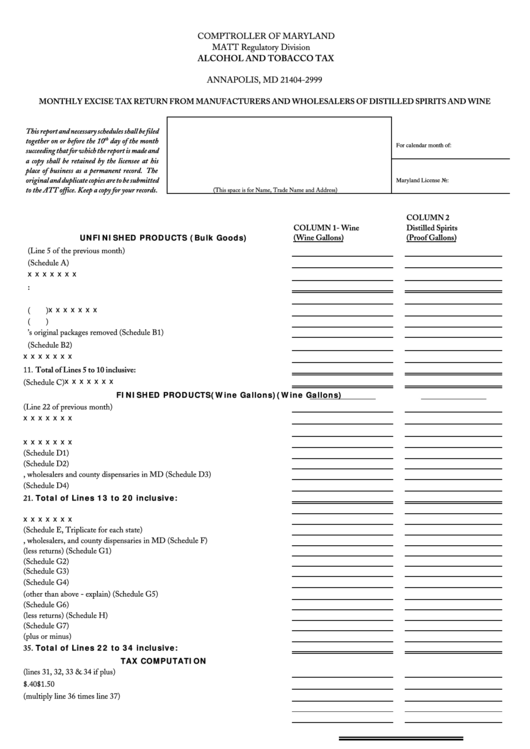

COMPTROLLER OF MARYLAND

MATT Regulatory Division

ALCOHOL AND TOBACCO TAX

P.O. BOX 2999

ANNAPOLIS, MD 21404-2999

MONTHLY EXCISE TAX RETURN FROM MANUFACTURERS AND WHOLESALERS OF DISTILLED SPIRITS AND WINE

This report and necessary schedules shall be filed

th

together on or before the 10

day of the month

For calendar month of:

succeeding that for which the report is made and

a copy shall be retained by the licensee at his

place of business as a permanent record. The

original and duplicate copies are to be submitted

Maryland License No:

to the ATT office. Keep a copy for your records.

(This space is for Name, Trade Name and Address)

COLUMN 2

COLUMN 1- Wine

Distilled Spirits

UNFINISHED PRODUCTS (Bulk Goods)

(Wine Gallons)

(Proof Gallons)

1. On hand first of month (Line 5 of the previous month)

2. Received on premises (Schedule A)

x x x x x x x

3. Received wine for rectification

4. Total of Line 1 to 3 inclusive:

5. On hand end of month

x x x x x x x

6. Dumped for rectification. No. of dumps (

)

7. Dumped for bottling without rectification. No. of dumps (

)

8. Manufacturer’s original packages removed (Schedule B1)

9. Losses (Schedule B2)

x x x x x x x

10. Wine transferred for rectification

11. Total of Lines 5 to 10 inclusive:

x x x x x x x

12. Packaged rectified products shipped (Schedule C)

FINISHED PRODUCTS

(Wine Gallons)

(Wine Gallons)

13. On hand first of month (Line 22 of previous month)

x x x x x x x

14. Bottled from rectification

15. Bottled without rectification

x x x x x x x

16. Received from rebottling

17. Received from Custom Bonded Warehouse (Schedule D1)

18. Received from dealers outside of MD (Schedule D2)

19. Received from mfgrs., wholesalers and county dispensaries in MD (Schedule D3)

20. Received from other sources (Schedule D4)

21. Total of Lines 13 to 20 inclusive:

22. On hand end of month

x x x x x x x

23. Wine transferred to rectification

24. Delivered to dealers outside of MD (Schedule E, Triplicate for each state)

25. Delivered to mfgrs., wholesalers, and county dispensaries in MD (Schedule F)

26. Delivered to Federal Reservations in MD (less returns) (Schedule G1)

27. Delivered to non-beverage permit holders in MD (Schedule G2)

28. Returned for bottling (Schedule G3)

29. Breakage (Schedule G4)

30. Disposed of (other than above - explain) (Schedule G5)

31. Samples (Schedule G6)

32. Delivered to retail licensees in MD (less returns) (Schedule H)

33. Winery sales to consumers (Schedule G7)

34. Unaccountable difference (plus or minus)

35. Total of Lines 22 to 34 inclusive:

TAX COMPUTATION

36. Taxable dispositions (lines 31, 32, 33 & 34 if plus)

37. Tax rate/gallon

$.40

$1.50

38. Total tax due (multiply line 36 times line 37)

39. Prior overpayment

40. Net tax due

41. Grand total of distilled spirits and wine tax due. Enclose check for this amount

AFFIDAVIT

I do solemnly declare and affirm under the penalties of perjury that the contents of the foregoing document are true and correct to the best of my knowledge,

information, and belief.

Signature

Title

Date

COM/ATT-034

Revised 7/08

1

1 2

2