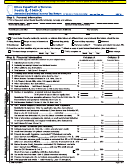

Supporting Documents for Form IL-1040-X

Do not mail this page with your Form IL-1040-X.

(including net operating loss (NOL) deductions)

Federal Changes

If you file Form IL-1040-X because you filed a U.S. Form 1040X or Form 1045 that resulted in

an overpayment or because you are claiming an NOL carryback deduction, you must wait to file this form until you

receive a federal finalization notice from the IRS stating that they have accepted your change either by paying a refund

or by final assessment, agreement, or judgment. Write the date the IRS notified you (not the date you filed your U.S.

Form 1040X or Form 1045) in the appropriate space in Step 1, Line F, and attach proof of federal finalization.

Proof of federal finalization for U.S. 1040X or Form 1045 overpayments and NOL carryback deductions includes

a copy of the notification you received from the IRS that they accepted your changes; e.g., a refund check, "Statement of

Account," agreement, or judgment, and

a copy of your U.S. Form 1040X, if filed, or

a copy of your U.S. Form 1045, Application for Tentative Refund, including all pages of Schedules A and B, along with

a copy of your refund check, if you filed your federal amended return due to an NOL.

a balance due, you must attach proof of federal finalization and write the date you filed your U.S. Form 1040X and paid

the tax due in the appropriate space in Step 1, Line F. Failure to provide this date could result in an assessment of a late-

payment penalty.

Proof of federal finalization for U.S. 1040X underpayments is a copy of your U.S. Form 1040X and a copy of the

check you sent to the IRS to pay the tax due.

If you do not have proof of federal finalization, call the IRS or go to their website at to request a tax

account transcript.

Line Changes

Attach the proper supporting documents, listed below, to your return.

If you are filing a civil union return, attach Schedule CU and a federal "as-if-married" return or schedule

for all lines requiring U.S. forms to be attached.

If you changed any of the lines identified below and do not attach the required supporting documents to your return,

we may partially or totally deny your claim.

If you corrected:

Line E

Schedule CU and a federal “as-if-married” return with

amended figures, including all schedules and attachments

Civil union return

Line 1

U.S. Form 1040, 1040X, or 1045 (with any Schedules A

and B) if an NOL.

Federal adjusted gross income

Note: If an NOL, you must complete and attach U.S. 1045

Schedule B, even if you did not file a U.S. 1045 for this year.

U.S. Form 1040 Schedules C, E, and F, if filed, for loss

years

Schedule K-1-P or K-1-T, or any other notification that was

furnished to you for partnership, S corporation, estate, and

trust income

Proof of federal finalization

Line 3

Schedule M with amended figures and any other required

support listed on Schedule M

Other additions

Line 5

U.S. Form 1040 or 1040A, Page 1, with amended figures

Social Security benefits and certain

Form W-2, if applicable

retirement plan income

Form 1099-R, RRB-1099, or SSA-1099, if applicable

Continued on the next page

IL-1040-X (R-12/13)

Page 3 of 4

1

1 2

2 3

3 4

4