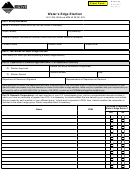

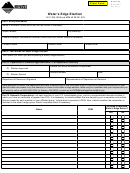

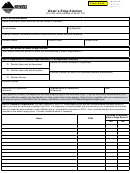

Form WE-ELECT

● Domestic international sales corporations, as described in 26

Who can make a water’s edge election?

U.S.C. 991 through 994, and foreign sales corporations, as

Only multinational corporations subject to the Montana corporate

described in 26 U.S.C. 921 through 927.

income tax may apportion income under a water’s edge, unitary

● Export trade corporations, as described in 26 U.S.C. 970 and

combination method as set forth in 15-31-322, MCA. Please refer

971.

to ARM 42.26.301.

● Foreign corporations deriving gain or loss from disposition of

When does the election need to be made?

a United States real property interest to the extent recognized

under 26 U.S.C. 897.

To perfect a water’s edge election, a taxpayer must complete this

form and file it with the department within the first 90 days of the

● A corporation incorporated outside the United States, if more

tax year for which the election is to become effective. If the first

than 50% of its voting stock is owned directly or indirectly by

tax period for which the election is to become effective is less

the taxpayer and if less than 80% of the average of its payroll

than 90 days, the taxpayer will have until the end of the tax period

and property is assignable to a location outside the United

to file the election. Under ARM 42.26.302, if you do not make a

States.

timely election then you cannot make an election for that particular

● A corporation incorporated in the United States, if the

year. Retroactive elections are not permissible. Please refer to

denominator of both the property and payroll factor is zero, is

ARM 42.26.302.

included in a water’s-edge return.

● A corporation incorporated outside the United States, if

How long is the water’s edge election good for?

“engaged in business” or “doing business” pursuant to 15-31-

Each election is binding for a three-year renewable period and

101, MCA, in this state, is included in a water’s-edge return.

may only be revoked upon express written permission of the

department. If a taxpayer wishes to continue to file on a water’s

● An affiliated entity that is in a unitary relationship with you and

edge basis, a Form WE-ELECT must again be filed with the

that is incorporated in a tax haven country. Please see 15-

department within the first 90 days of the tax year for which the

31-322, MCA. Tax haven countries currently include Andorra,

election is to become effective. Please refer to 15-31-324, MCA

Anguilla, Antigua and Barbuda, Aruba, the Bahamas,

Bahrain, Barbados, Belize, Bermuda, British Virgin Islands,

and ARM 42.26.302.

Cayman Islands, Cook Islands, Cyprus, Dominica, Gibraltar,

How will I know if I have a valid water’s edge

Grenada, Guernsey-Sark-Alderney, Isle of Man, Jersey,

Liberia, Liechtenstein, Luxembourg, Malta, Marshall Islands,

election?

Mauritius, Monaco, Montserrat, Nauru, Netherlands Antilles,

Upon receipt of this form, the department will either approve

Niue, Panama, Samoa, San Marino, Seychelles, St. Kitts

or deny your water’s edge election request by marking the

and Nevis, St. Lucia, St. Vincent and the Grenadines, Turks

appropriate box, indicating the date of approval or denial, and

and Caicos Islands, U.S. Virgin Islands and Vanuatu. This list

providing the signature and name of the person who approved

has been updated and is effective for periods beginning after

or denied your request. Your form will be sent back to you with a

December 31, 2008.

letter from the department either providing additional information

regarding your valid water’s edge election or an explanation as to

● A portion of the after-tax net income of United States

why your water’s edge election request has been denied. If you

corporations that are excluded as 80/20 companies, and the

do not receive this confirmation from the department within two

United States possession corporations described in Sections

weeks or by the deadline to make a valid water’s edge election,

931 through 934 and Section 936 of the IRC, are considered

there may be a problem with your request and you will need to

dividends received from corporations that are incorporated

contact us.

outside of the United States. These deemed dividends are

included in the apportionable income and are calculated on

Who can be included in the water’s edge

the Schedule WE of the CIT.

combined group?

Please refer to ARM 42.26.311.

The water’s edge combined return includes only the income and

What information do I have to include with my tax

apportionment factors of the members of the unitary group that

meet the criteria set forth in 15-31-322, MCA, and summarized

return when I have a valid water’s edge election?

below. If your affiliated entity meets any one of these criteria and

If you have a valid water’s edge election, you will need to fill out

is unitary, it is included in your combined return. If your affiliated

Schedule WE and include it, and any supporting schedules, with

entity does not meet any of these criteria, it is excluded from your

the filing of your return.

combined return.

How do I treat net operating losses (NOLs) as a

● An affiliated entity that:

water’s edge filer?

○ is incorporated in the United States,

A corporation that makes a valid water’s edge election or does

○ is in a unitary relationship with you,

not renew a prior election is agreeing that unused NOL carryover

○ has less than 80% of its average payroll and property

from a water’s edge year may only be carried to a water’s edge

assigned to locations outside the United States, and

year, and unused NOL carryover from a non-water’s edge year

○ is eligible to be included in a federal consolidated tax return

may only be carried to a non-water’s edge year. When applying

as described in 26 U.S.C. 1501 through 1505, with the

the three-year carryback and seven-year carryforward limitations,

exception that the 80% ownership requirement described in

provided for in 15-31-119, MCA, all taxable periods are included,

26 U.S.C. 1504 is reduced to ownership of more than 50%

even though the loss can only be deducted in those periods

of the voting stock directly or indirectly owned or controlled

in which the filing method is the same. Please refer to ARM

by a member of the water’s edge group.

42.23.805.

1

1 2

2 3

3 4

4