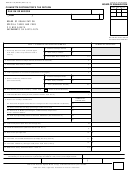

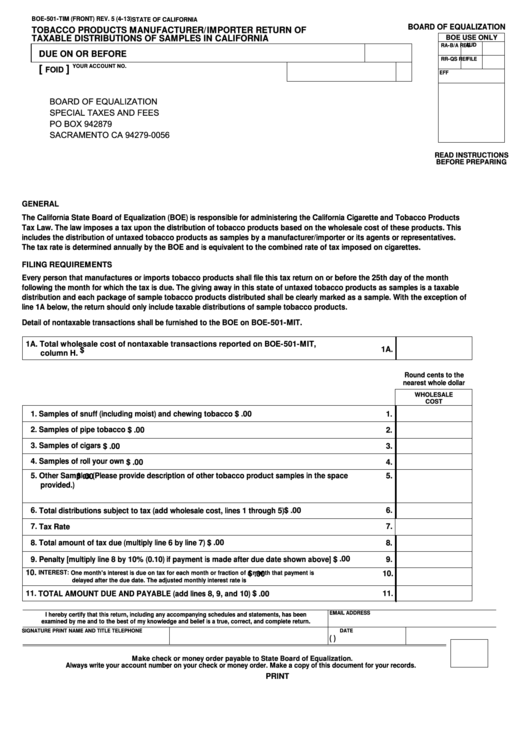

BOE-501-TIM (FRONT) REV. 5 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

TOBACCO PRODUCTS MANUFACTURER/IMPORTER RETURN OF

TAXABLE DISTRIBUTIONS OF SAMPLES IN CALIFORNIA

BOE USE ONLY

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-0056

READ INSTRUCTIONS

BEFORE PREPARING

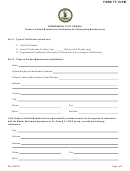

GENERAL

The California State Board of Equalization (BOE) is responsible for administering the California Cigarette and Tobacco Products

Tax Law. The law imposes a tax upon the distribution of tobacco products based on the wholesale cost of these products. This

includes the distribution of untaxed tobacco products as samples by a manufacturer/importer or its agents or representatives.

The tax rate is determined annually by the BOE and is equivalent to the combined rate of tax imposed on cigarettes.

FILING REQUIREMENTS

Every person that manufactures or imports tobacco products shall file this tax return on or before the 25th day of the month

following the month for which the tax is due. The giving away in this state of untaxed tobacco products as samples is a taxable

distribution and each package of sample tobacco products distributed shall be clearly marked as a sample. With the exception of

line 1A below, the return should only include taxable distributions of sample tobacco products.

Detail of nontaxable transactions shall be furnished to the BOE on BOE-501-MIT.

1A. Total wholesale cost of nontaxable transactions reported on BOE-501-MIT,

1A.

$

column H.

Round cents to the

nearest whole dollar

WHOLESALE

COST

1. Samples of snuff (including moist) and chewing tobacco

1.

$

.00

2. Samples of pipe tobacco

2.

$

.00

3. Samples of cigars

3.

$

.00

4. Samples of roll your own

4.

$

.00

5. Other Samples (Please provide description of other tobacco product samples in the space

5.

$

.00

provided.)

6. Total distributions subject to tax (add wholesale cost, lines 1 through 5)

6.

$

.00

7. Tax Rate

7.

.00

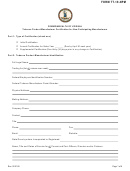

8. Total amount of tax due (multiply line 6 by line 7)

8.

$

.00

9. Penalty [multiply line 8 by 10% (0.10) if payment is made after due date shown above]

9.

$

10.

10.

$

.00

INTEREST: One month's interest is due on tax for each month or fraction of a month that payment is

delayed after the due date. The adjusted monthly interest rate is

11. TOTAL AMOUNT DUE AND PAYABLE (add lines 8, 9, and 10)

11.

$

.00

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

CLEAR

PRINT

1

1 2

2