TPP 807F

Rev. 5/04

Instructions

Page 2

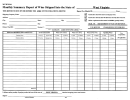

Monthly Inventory – Cost of Sales Method

Method for Establishing Cost of Sales Percentage – Example

Inventory figures should come from monthly trial balances

1/01/05

47,050

Beginning Inventory

Date:

$

Plus: Net purchases for year

+

$

375,140

=

$

422,190

Less: Ending inventory

Date:

-

$

12/31/05

49,675

Cost of goods sold .................................................................................................................................

$

372,515

625,655

Cost of sales

$

372,515

÷

Net sales

$

=

59.54%

Net purchases: Must include all deliveries during the month, freight-in, sales and excise taxes and exclude discounts earned.

Manufacturers are to include direct labor and manufacturing burden.

Net sales:

Should not include any service charges or sales or excise taxes (unless such excise tax is included in the

cost to the taxpayer).

To Calculate Monthly Inventory:

Add the Jan. 1 inventory ($47,050), the January net purchases ($31,293); deduct January sale at cost ($37,671 @ 59.54% =

$22, 429). The result will be the estimated amount of inventory on hand Jan. 31 ($55,914). The inventory on Jan. 31 ($55,914),

plus February net purchases ($27,675), less sales at cost ($47,698 @ 59.54% = $28,399) gives Feb. 28 inventory ($55,190).

Correct computation for each month throughout the year should give a Dec. 31 inventory very close to actual inventory at Dec.

31. Actual inventory for Dec. 31 will be recorded in column 5.

Column 1

Column 2

Column 3

Column 4

Column 5

Net Purchases

Sales at Cost

Beginning

(manufacturers include

59.54% of Net Sales

Estimated

Inventory

direct labor and burden)

Net Sales

Column 3

Monthly Inventory

1/01/03

47,050

Date:

$

$

$

$

January

$31,293

$37,671

$22,429

$55,914

February

27,675

47,698

28,399

55,190

March

45,415

55,862

75,148

44,743

April

29,421

52,083

31,010

54,273

May

21,763

62,791

37,385

38,651

June

17,561

40,083

23,865

32,347

July

18,076

24,037

14,311

36,112

August

21,006

30,710

18,285

38,833

September

45,761

59,984

41,344

24,610

October

53,411

52,791

31,431

81,964

November

30,130

75,000

44,654

67,440

December

33,628

51,393

49,675

86,319

Total

$

$

$

$

375,140

625,655

372,515

626,245

$

626,245

12

Average Estimated Monthly Inventory

÷

=

$

52,187

(Total column 5)

(Months)

0.00%

List value, merchant or manufacturer

$

1

1 2

2