Clear This Page

* 0 2 7 1 1 4 0 1 0 2 0 0 0 0 *

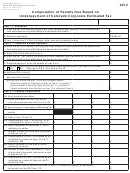

Exception 3 worksheet—To figure annualized income

(a)

(b)

(c)

(d)

15. Number of months in

annualization period (see

•

•

•

•

instructions) ....15

16. Actual income for the period

on line 15, less net losses

carried forward from prior

•

•

•

•

tax years .........16

17. Annualization factors based

on selected annualized period

(see instr.) .......17

18. Annualized income (line

16 x line 17) ....18

19. Annualized tax (see tax rate chart

in instr. for Form 20, 20-I, 20-INS,

or 20-S) .............19

20. Less credits corporation

is entitled to for months

shown in each column

•

•

•

•

on line 15 ........20

21. Net annualized tax (use to

figure line 13) ...21

Part III—Interest on underpayments (see instructions)

(a)

(b)

(c)

(d)

22. Enter the amount of under-

payment from line 10. If no

underpayment, enter 0 ...22

23. Date estimated

payment was due .........23

24. Date underpayment was

paid or the due date of

the following installment,

whichever is earlier .......24

25. Number of full months

between dates on

lines 23 and 24 .............25

26. Number of days in a

partial month between

dates on lines 23 and 24 ...26

27. Number of full months

on line 25 x monthly

interest rates x line 22 ...27

28. Number of days on

line 26 x daily interest

rates x line 22 ...............28

29. Interest due (line 27

plus line 28) ..................29

30. Total interest due [add line 29, columns (a), (b), (c), and (d)] ......................................................................................... 30

Enter the amount from line 30 above on the “interest on underpayment of estimated tax” line of Form 20,

Form 20-I, Form 20-S, or Form 20-INS. Include this form with your return and check the “Form 37” box.

150-102-037 (Rev. 10-14) Form 37, page 2 of 3

1

1 2

2 3

3