Instructions For Form 20-S - Oregon S-Corporation Tax Return - 2014

ADVERTISEMENT

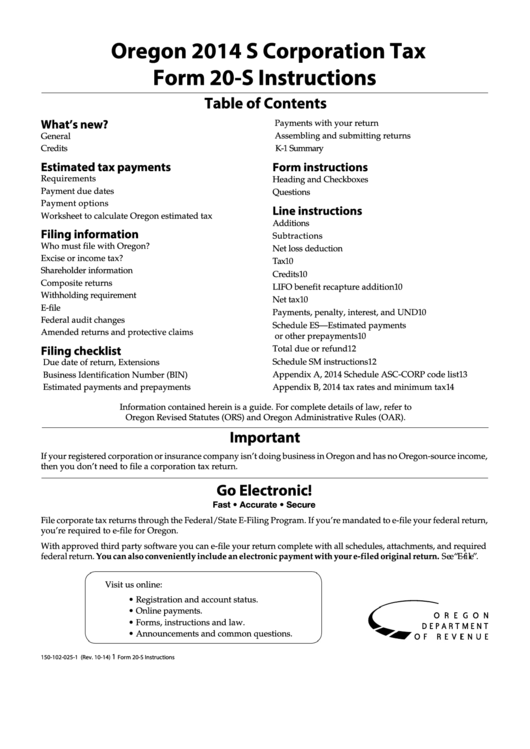

Oregon 2014 S Corporation Tax

Form 20-S Instructions

Table of Contents

What’s new?

Payments with your return ............................................6

Assembling and submitting returns ............................6

General...................................................................................2

Credits ....................................................................................2

K-1 Summary ...................................................................6

Estimated tax payments

Form instructions

Requirements ........................................................................3

Heading and Checkboxes ...................................................6

Payment due dates ...............................................................3

Questions ...............................................................................8

Payment options ...................................................................3

Line instructions

Worksheet to calculate Oregon estimated tax .................3

Additions ...............................................................................8

Filing information

Subtractions ..........................................................................9

Who must file with Oregon? ..............................................4

Net loss deduction ...............................................................9

Excise or income tax? ...........................................................4

Tax ........................................................................................ 10

Shareholder information .....................................................4

Credits .................................................................................. 10

Composite returns ...............................................................4

LIFO benefit recapture addition ...................................... 10

Withholding requirement ...................................................5

Net tax .................................................................................. 10

E-file .......................................................................................5

Payments, penalty, interest, and UND ............................ 10

Federal audit changes ..........................................................5

Schedule ES—Estimated payments

Amended returns and protective claims .........................5

or other prepayments ................................................... 10

Filing checklist

Total due or refund ............................................................12

Schedule SM instructions .................................................12

Due date of return, Extensions ......................................6

Appendix A, 2014 Schedule ASC-CORP code list .........13

Business Identification Number (BIN) .........................6

Estimated payments and prepayments .......................6

Appendix B, 2014 tax rates and minimum tax ............... 14

Information contained herein is a guide. For complete details of law, refer to

Oregon Revised Statutes (ORS) and Oregon Administrative Rules (OAR).

Important

If your registered corporation or insurance company isn’t doing business in Oregon and has no Oregon-source income,

then you don’t need to file a corporation tax return.

Go Electronic!

Fast • Accurate • Secure

File corporate tax returns through the Federal/State E-Filing Program. If you’re mandated to e-file your federal return,

you’re required to e-file for Oregon.

With approved third party software you can e-file your return complete with all schedules, attachments, and required

federal return. You can also conveniently include an electronic payment with your e-filed original return. See “E-file”.

Visit us online:

• Registration and account status.

• Online payments.

• Forms, instructions and law.

• Announcements and common questions.

1

150-102-025-1 (Rev. 10-14)

Form 20-S Instructions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14