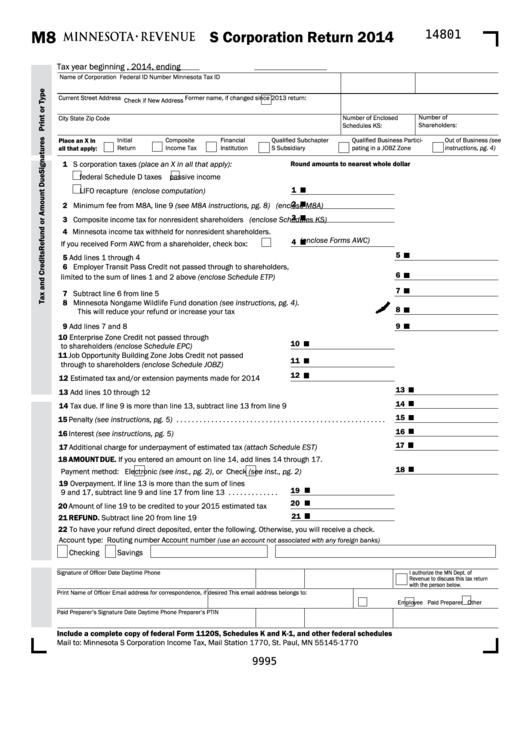

M8

S Corporation Return 2014

14801

Tax year beginning

, 2014, ending

Name of Corporation

Federal ID Number

Minnesota Tax ID

Current Street Address

Former name, if changed since 2013 return:

Check if New Address

Number of

Number of Enclosed

City

State

Zip Code

Shareholders:

Schedules KS:

Initial

Composite

Financial

Qualified Subchapter

Qualified Business Partici-

Out of Business (see

Place an X in

Return

Income Tax

Institution

S Subsidiary

pating in a JOBZ Zone

instructions, pg. 4)

all that apply:

1 S corporation taxes (place an X in all that apply):

Round amounts to nearest whole dollar

federal Schedule D taxes

passive income

1

(enclose computation)

LIFO recapture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Minimum fee from M8A, line 9 (see M8A instructions, pg. 8) . . . .

(enclose M8A)

3

3 Composite income tax for nonresident shareholders . . . . . . . . . . .

(enclose Schedules KS)

4 Minnesota income tax withheld for nonresident shareholders .

(enclose Forms AWC)

4

If you received Form AWC from a shareholder, check box:

. . . .

5

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Employer Transit Pass Credit not passed through to shareholders,

6

limited to the sum of lines 1 and 2 above (enclose Schedule ETP) . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Minnesota Nongame Wildlife Fund donation (see instructions, pg. 4).

8

This will reduce your refund or increase your tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Enterprise Zone Credit not passed through

10

to shareholders (enclose Schedule EPC) . . . . . . . . . . . . . . . . . . . . .

11 Job Opportunity Building Zone Jobs Credit not passed

11

through to shareholders (enclose Schedule JOBZ) . . . . . . . . . . . . .

12

12 Estimated tax and/or extension payments made for 2014 . . . . . .

13

13 Add lines 10 through 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14 Tax due . If line 9 is more than line 13, subtract line 13 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . .

15

15 Penalty (see instructions, pg. 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16 Interest (see instructions, pg. 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17 Additional charge for underpayment of estimated tax (attach Schedule EST) . . . . . . . . . . . . . . . . . .

18 AMOUNT DUE. If you entered an amount on line 14, add lines 14 through 17 .

18

Payment method:

Electronic (see inst., pg. 2), or

Check (see inst., pg. 2) . . . . . . . . . . . . . .

19 Overpayment . If line 13 is more than the sum of lines

19

9 and 17, subtract line 9 and line 17 from line 13 . . . . . . . . . . . . .

20

20 Amount of line 19 to be credited to your 2015 estimated tax . . . .

21

21 REFUND. Subtract line 20 from line 19 . . . . . . . . . . . . . . . . . . . . . .

22 To have your refund direct deposited, enter the following . Otherwise, you will receive a check .

Account type:

Routing number

Account number

(use an account not associated with any foreign banks)

Checking

Savings

Signature of Officer

Date

Daytime Phone

I authorize the MN Dept . of

Revenue to discuss this tax return

with the person below .

Print Name of Officer

Email address for correspondence, if desired

This email address belongs to:

Employee

Paid Preparer

Other

Paid Preparer’s Signature

Date

Daytime Phone

Preparer’s PTIN

Include a complete copy of federal Form 1120S, Schedules K and K-1, and other federal schedules

Mail to: Minnesota S Corporation Income Tax, Mail Station 1770, St . Paul, MN 55145-1770

9995

1

1 2

2