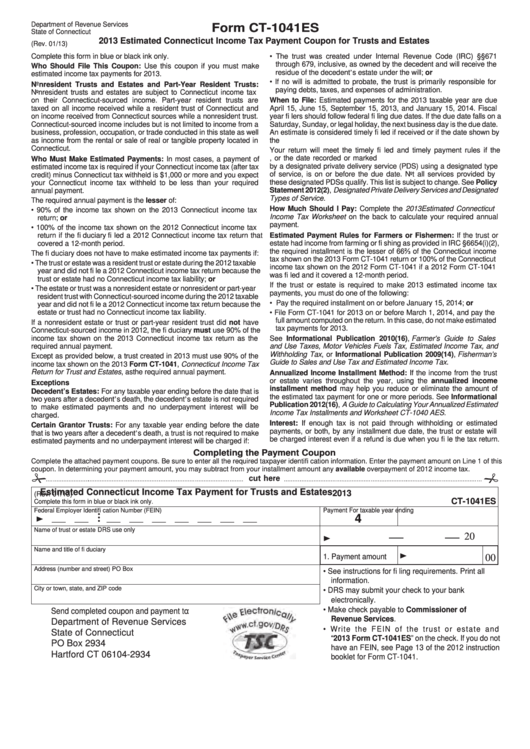

Form Ct-1041es - Estimated Connecticut Income Tax Payment Coupon For Trusts And Estates - 2013

ADVERTISEMENT

Department of Revenue Services

Form CT-1041ES

State of Connecticut

2013 Estimated Connecticut Income Tax Payment Coupon for Trusts and Estates

(Rev. 01/13)

Complete this form in blue or black ink only.

• The trust was created under Internal Revenue Code (IRC) §§671

through 679, inclusive, as owned by the decedent and will receive the

Who Should File This Coupon: Use this coupon if you must make

residue of the decedent’s estate under the will; or

estimated income tax payments for 2013.

• If no will is admitted to probate, the trust is primarily responsible for

Nonresident Trusts and Estates and Part-Year Resident Trusts:

paying debts, taxes, and expenses of administration.

Nonresident trusts and estates are subject to Connecticut income tax

on their Connecticut-sourced income. Part-year resident trusts are

When to File: Estimated payments for the 2013 taxable year are due

April 15, June 15, September 15, 2013, and January 15, 2014. Fiscal

taxed on all income received while a resident trust of Connecticut and

on income received from Connecticut sources while a nonresident trust.

year fi lers should follow federal fi ling due dates. If the due date falls on a

Connecticut-sourced income includes but is not limited to income from a

Saturday, Sunday, or legal holiday, the next business day is the due date.

business, profession, occupation, or trade conducted in this state as well

An estimate is considered timely fi led if received or if the date shown by

as income from the rental or sale of real or tangible property located in

the U.S. Postal Service cancellation mark is on or before the due date.

Connecticut.

Your return will meet the timely fi led and timely payment rules if the

U.S. Postal Service cancellation date, or the date recorded or marked

Who Must Make Estimated Payments: In most cases, a payment of

by a designated private delivery service (PDS) using a designated type

estimated income tax is required if your Connecticut income tax (after tax

of service, is on or before the due date. Not all services provided by

credit) minus Connecticut tax withheld is $1,000 or more and you expect

these designated PDSs qualify. This list is subject to change. See Policy

your Connecticut income tax withheld to be less than your required

Statement 2012(2), Designated Private Delivery Services and Designated

annual payment.

Types of Service.

The required annual payment is the lesser of:

How Much Should I Pay: Complete the 2013 Estimated Connecticut

• 90% of the income tax shown on the 2013 Connecticut income tax

Income Tax Worksheet on the back to calculate your required annual

return; or

payment.

• 100% of the income tax shown on the 2012 Connecticut income tax

Estimated Payment Rules for Farmers or Fishermen: If the trust or

return if the fi duciary fi led a 2012 Connecticut income tax return that

covered a 12-month period.

estate had income from farming or fi shing as provided in IRC §6654(i)(2),

the required installment is the lesser of 66⅔ of the Connecticut income

The fi duciary does not have to make estimated income tax payments if:

tax shown on the 2013 Form CT-1041 return or 100% of the Connecticut

• The trust or estate was a resident trust or estate during the 2012 taxable

income tax shown on the 2012 Form CT-1041 if a 2012 Form CT-1041

year and did not fi le a 2012 Connecticut income tax return because the

was fi led and it covered a 12-month period.

trust or estate had no Connecticut income tax liability; or

If the trust or estate is required to make 2013 estimated income tax

• The estate or trust was a nonresident estate or nonresident or part-year

payments, you must do one of the following:

resident trust with Connecticut-sourced income during the 2012 taxable

• Pay the required installment on or before January 15, 2014; or

year and did not fi le a 2012 Connecticut income tax return because the

estate or trust had no Connecticut income tax liability.

• File Form CT-1041 for 2013 on or before March 1, 2014, and pay the

full amount computed on the return. In this case, do not make estimated

If a nonresident estate or trust or part-year resident trust did not have

tax payments for 2013.

Connecticut-sourced income in 2012, the fi duciary must use 90% of the

income tax shown on the 2013 Connecticut income tax return as the

See Informational Publication 2010(16), Farmer’s Guide to Sales

required annual payment.

and Use Taxes, Motor Vehicles Fuels Tax, Estimated Income Tax, and

Withholding Tax, or Informational Publication 2009(14), Fisherman’s

Except as provided below, a trust created in 2013 must use 90% of the

Guide to Sales and Use Tax and Estimated Income Tax.

income tax shown on the 2013 Form CT-1041, Connecticut Income Tax

Return for Trust and Estates, as the required annual payment.

Annualized Income Installment Method: If the income from the trust

or estate varies throughout the year, using the annualized income

Exceptions

installment method may help you reduce or eliminate the amount of

Decedent’s Estates: For any taxable year ending before the date that is

the estimated tax payment for one or more periods. See Informational

two years after a decedent’s death, the decedent’s estate is not required

Publication 2012(16), A Guide to Calculating Your Annualized Estimated

to make estimated payments and no underpayment interest will be

Income Tax Installments and Worksheet CT-1040 AES.

charged.

Interest: If enough tax is not paid through withholding or estimated

Certain Grantor Trusts: For any taxable year ending before the date

payments, or both, by any installment due date, the trust or estate will

that is two years after a decedent’s death, a trust is not required to make

be charged interest even if a refund is due when you fi le the tax return.

estimated payments and no underpayment interest will be charged if:

Completing the Payment Coupon

Complete the attached payment coupons. Be sure to enter all the required taxpayer identifi cation information. Enter the payment amount on Line 1 of this

coupon. In determining your payment amount, you may subtract from your installment amount any available overpayment of 2012 income tax.

cut here

Estimated Connecticut Income Tax Payment for Trusts and Estates

2013

(Rev. 01/13)

CT-1041ES

Complete this form in blue or black ink only.

Payment

For taxable year ending

Federal Employer Identifi cation Number (FEIN)

•

4

___

___

•

___

___

___

___

___

___

___

•

Name of trust or estate

DRS use only

20

Name and title of fi duciary

1. Payment amount

00

Address (number and street)

PO Box

• See instructions for fi ling requirements. Print all

information.

City or town, state, and ZIP code

• DRS may submit your check to your bank

electronically.

• Make check payable to Commissioner of

Send completed coupon and payment to:

Revenue Services.

Department of Revenue Services

• Write the FEIN of the trust or estate and

State of Connecticut

“2013 Form CT-1041ES” on the check. If you do not

PO Box 2934

have an FEIN, see Page 13 of the 2012 instruction

Hartford CT 06104-2934

booklet for Form CT-1041.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3