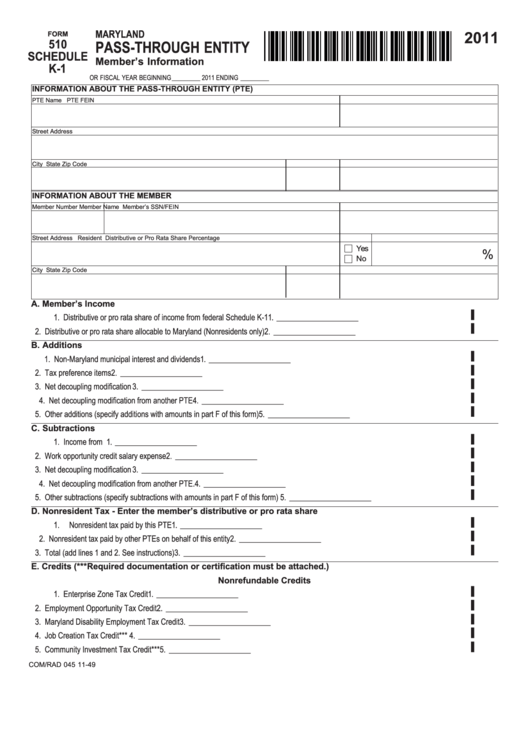

MARYLAND

2011

FORM

510

PASS-THROUGH ENTITY

SCHEDULE

Member’s Information

11510K049

K-1

OR FISCAL YEAR BEGINNING _________ 2011 ENDING _________

INFORMATION ABOUT THE PASS-THROUGH ENTITY (PTE)

PTE Name

PTE FEIN

Street Address

City

State

Zip Code

INFORMATION ABOUT THE MEMBER

Member Number

Member Name

Member’s SSN/FEIN

Street Address

Resident

Distributive or Pro Rata Share Percentage

Yes

%

No

City

State

Zip Code

A. Member’s Income

▌

1. Distributive or pro rata share of income from federal Schedule K-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _____________________

▌

2. Distributive or pro rata share allocable to Maryland (Nonresidents only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. _____________________

B. Additions

▌

1. Non-Maryland municipal interest and dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _____________________

▌

2. Tax preference items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. _____________________

▌

3. Net decoupling modification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. _____________________

▌

4. Net decoupling modification from another PTE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4. _____________________

▌

5. Other additions (specify additions with amounts in part F of this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5. _____________________

C. Subtractions

▌

1. Income from U.S. obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _____________________

▌

2. Work opportunity credit salary expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. _____________________

▌

3. Net decoupling modification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. _____________________

▌

4. Net decoupling modification from another PTE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4. _____________________

▌

5. Other subtractions (specify subtractions with amounts in part F of this form) . . . . . . . . . . . . . . . . . . . . . . . . .5. _____________________

D. Nonresident Tax - Enter the member’s distributive or pro rata share

▌

1. Nonresident tax paid by this PTE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _____________________

▌

2. Nonresident tax paid by other PTEs on behalf of this entity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. _____________________

▌

3. Total (add lines 1 and 2. See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. _____________________

E. Credits (***Required documentation or certification must be attached.)

Nonrefundable Credits

▌

1. Enterprise Zone Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _____________________

▌

2. Employment Opportunity Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. _____________________

▌

3. Maryland Disability Employment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. _____________________

▌

4. Job Creation Tax Credit*** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4. _____________________

▌

5. Community Investment Tax Credit*** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5. _____________________

COM/RAD 045

11-49

1

1 2

2 3

3