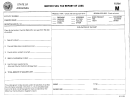

Schedule Mf-R - Motor Fuels Tax Schedule Of Receipts Page 2

ADVERTISEMENT

Schedule Instructions

Column 4 Point of origin or destination. Enter the location the product was transported

from and to. When received into or from a terminal, use the IRS Terminal Control Number.

A separate Schedule MF-R, Motor Fuels Tax Schedule of Receipts, must be completed for

each product code and attached to the appropriate tax return. Complete a separate Sched-

Column 5 Acquired from. Enter the name of the company the product was acquired from.

ule MF-R for each schedule required. Prepare in duplicate and retain a copy for your records.

Column 6, Seller’s FEIN. Enter the FEIN of the company the product was acquired from.

Schedule 1. Report all receipts (including exchanges) from sources outside Massachusetts.

Column 7, Date received. Enter the date the product was received.

Schedule 2. Report all receipts (including exchanges) from sources within Massachusetts.

Column 8, Document number. For rack purchases, enter the identifying number from the

Schedule 3. Report all shipments to other states.

document issued at the terminal (BOL number). In the case of pipeline or barge move-

ments, it is the pipeline or barge ticket number.

Schedule 4. Report all direct shipments to customers in Massachusetts.

Column 9, Billed whole gallons. Enter the amount of gallons received (including ex-

Schedule 5. Report all other receipts.

changes). Round off to the nearest whole gallon.

Column Instructions

Column 10, Tax-free or tax-paid. State whether product was purchased tax-free or with

Columns 1 and 2, Carrier. Enter the name and FEIN of the company that transports the

the Massachusetts tax included.

product.

General Instructions

Column 3, Mode of transport. Enter the mode of transportation. Use one of the following:

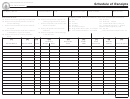

You must report monthly gallon subtotals by vendor and product. All gallons must be rounded

TR = truck

to the nearest whole gallon.

R = rail

You must file a separate form for each product and include product code with schedule

B = barge

number.

PL = pipeline

S = ship (ocean marine vessel)

For further information on the motor fuels tax, call the Excise Tax Unit at 617-887-5060.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2