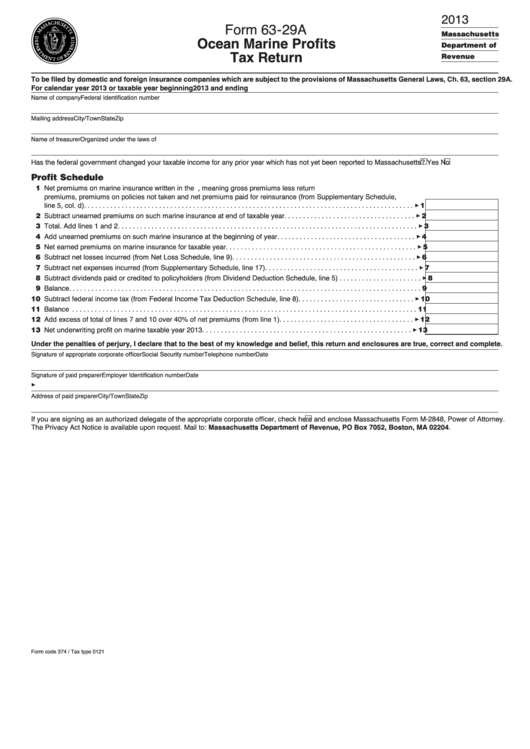

2013

Form 63-29A

Ocean Marine Profits

Tax Return

Massachusetts

Department of

Revenue

To be filed by domestic and foreign insurance companies which are subject to the provisions of Massachusetts General Laws, Ch. 63, section 29A.

For calendar year 2013 or taxable year beginning

2013 and ending

Name of company

Federal Identification number

Mailing address

City/Town

State

Zip

Name of treasurer

Organized under the laws of

Has the federal government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No

Profit Schedule

11 Net premiums on marine insurance written in the U.S. during the taxable year, meaning gross premiums less return

premiums, premiums on policies not taken and net premiums paid for reinsurance (from Supplementary Schedule,

line 5, col. d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Subtract unearned premiums on such marine insurance at end of taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

13 Total. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

14 Add unearned premiums on such marine insurance at the beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

15 Net earned premiums on marine insurance for taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

16 Subtract net losses incurred (from Net Loss Schedule, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

17 Subtract net expenses incurred (from Supplementary Schedule, line 17). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

18 Subtract dividends paid or credited to policyholders (from Dividend Deduction Schedule, line 5) . . . . . . . . . . . . . . . . . . . . . .

7

19 Balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

8

10 Subtract federal income tax (from Federal Income Tax Deduction Schedule, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

10

12 Add excess of total of lines 7 and 10 over 40% of net premiums (from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Net underwriting profit on marine taxable year 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Under the penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate corporate officer

Social Security number

Telephone number

Date

Signature of paid preparer

Employer Identification number

Date

Address of paid preparer

City/Town

State

Zip

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and enclose Massachusetts Form M-2848, Power of Attorney.

The Privacy Act Notice is available upon request. Mail to: Massachusetts Department of Revenue, PO Box 7052, Boston, MA 02204.

Form code 374 / Tax type 0121

1

1 2

2 3

3 4

4 5

5