Form Wcs-1 - Public Safety Communications Surcharge Return

ADVERTISEMENT

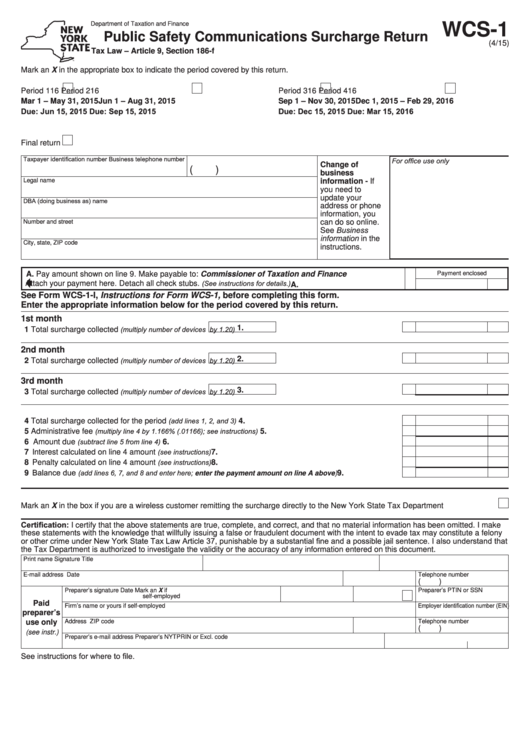

WCS-1

Department of Taxation and Finance

Public Safety Communications Surcharge Return

(4/15)

Tax Law – Article 9, Section 186-f

Mark an X in the appropriate box to indicate the period covered by this return.

Period 116

Period 216

Period 316

Period 416

Mar 1 – May 31, 2015

Jun 1 – Aug 31, 2015

Sep 1 – Nov 30, 2015

Dec 1, 2015 – Feb 29, 2016

Due: Jun 15, 2015

Due: Sep 15, 2015

Due: Dec 15, 2015

Due: Mar 15, 2016

Final return

Taxpayer identification number

Business telephone number

For office use only

Change of

(

)

business

Legal name

information - If

you need to

update your

DBA (doing business as) name

address or phone

information, you

can do so online.

Number and street

See Business

information in the

City, state, ZIP code

instructions.

A. Pay amount shown on line 9. Make payable to: Commissioner of Taxation and Finance

Payment enclosed

(See instructions for details.)

Attach your payment here. Detach all check stubs.

A.

See Form WCS-1-I, Instructions for Form WCS-1, before completing this form.

Enter the appropriate information below for the period covered by this return.

1st month

(multiply number of devices

by 1.20)

1.

1 Total surcharge collected

...........................................

2nd month

2.

(multiply number of devices

by 1.20)

2 Total surcharge collected

...........................................

3rd month

(multiply number of devices

by 1.20)

3.

3 Total surcharge collected

...........................................

(add lines 1, 2, and 3)

4 Total surcharge collected for the period

..........................................................................

4.

(multiply line 4 by 1.166% (.01166); see instructions)

5 Administrative fee

................................................................

5.

(subtract line 5 from line 4)

6 Amount due

..............................................................................................................

6.

(see instructions)

7 Interest calculated on line 4 amount

......................................................................................

7.

(see instructions)

8 Penalty calculated on line 4 amount

......................................................................................

8.

9 Balance due

(add lines 6, 7, and 8 and enter here; enter the payment amount on line A above)

.............................

9.

Mark an X in the box if you are a wireless customer remitting the surcharge directly to the New York State Tax Department .........................

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make

these statements with the knowledge that willfully issuing a false or fraudulent document with the intent to evade tax may constitute a felony

or other crime under New York State Tax Law Article 37, punishable by a substantial fine and a possible jail sentence. I also understand that

the Tax Department is authorized to investigate the validity or the accuracy of any information entered on this document.

Print name

Signature

Title

E-mail address

Date

Telephone number

(

)

Preparer’s signature

Date

Mark an X if

Preparer’s PTIN or SSN

self-employed

Paid

Employer identification number (EIN)

Firm’s name or yours if self-employed

preparer’s

use only

Address

ZIP code

Telephone number

(

)

(see instr.)

Preparer’s e-mail address

Preparer’s NYTPRIN

or

Excl. code

See instructions for where to file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1