Form 207/207 Hcc Ext - Application For Extension Of Time To File Domestic Insurance Premiums Tax Return Or Health Care Center Tax Return - 2014 Page 2

ADVERTISEMENT

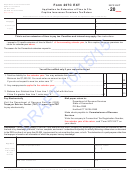

Form 207/207 HCC EXT

Instructions

Use Form 207/207 HCC EXT, Application for Extension of Time

Where to File

to File Domestic Insurance Premiums Tax Return or Health Care

Make check payable to Commissioner of Revenue

Center Tax Return, to request a 12-month extension to fi le your

Services. To ensure payment is applied to your account,

Connecticut insurance premiums or health care center tax return.

write “2014 Form 207/207 HCC EXT” and your Connecticut

Complete this application in blue or black ink only.

Tax Registration Number on the front of your check. Be sure

to sign your check and paper clip it to the front of your return.

Request for Extension

Do not send cash. DRS may submit your check to your

An insurance company or health care center may request a

bank electronically.

12-month extension to fi le its Connecticut tax return provided

Mail to:

Department of Revenue Services

there is reasonable cause for the request.

State of Connecticut

To request an extension of time to fi le a Connecticut domestic

PO Box 2990

insurance premiums tax return or health care center tax

Hartford CT 06104-2990

return, check the applicable box on the front of this form. File

Failure to fi le or failure to pay the proper amount of tax due will

Form 207/207 HCC EXT and pay all the tax you expect to owe

on or before March 1, 2015.

result in penalty and interest charges. It is to your advantage

to fi le when your return is due whether or not you are able to

Form 207/207 HCC EXT only extends the time to fi le your

make full payment.

tax return. Form 207/207 HCC EXT does not extend the

time to pay the amount of tax due.

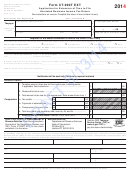

Signature

We will notify you only if the extension request is denied.

The treasurer of the company, or a principal offi cer of the

company, must sign Form 207/207 HCC EXT.

Name, Address, and Tax Registration Number

Enter the company’s name, address, Federal Employer

Paid Preparer Signature

Identifi cation Number (FEIN), and Connecticut Tax Registration

A paid preparer must sign and date Form 207/207 HCC EXT.

Number in the spaces provided.

Paid preparers must also enter their Social Security Number

(SSN) or Preparer Tax Identifi cation Number (PTIN) and their

Rounding Off to Whole Dollars

fi rm’s FEIN in the spaces provided.

You must round off cents to the nearest whole dollar on your

return and schedules. If you do not round, the Department of

Pay Electronically

Revenue Services (DRS) will disregard the cents.

Visit to use the Taxpayer

Round down to the next lowest dollar all amounts that include

Service Center (TSC) to make a direct tax

1 through 49 cents. Round up to the next highest dollar all

payment. After logging into the TSC, select

amounts that include 50 through 99 cents. However, if you

the Make Payment Only option and choose a tax type from

need to add two or more amounts to compute the amount

the drop down box. Using this option authorizes DRS to

to enter on a line, include cents and round off only the total.

electronically withdraw from your bank account (checking or

savings) a payment on a date you select up to the due date.

Example: Add two amounts ($1.29 + $3.21) to compute the

As a reminder, even if you pay electronically you must still

total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and

fi le your return on or before the due date. Tax not paid on or

entered on a line.

before the due date will be subject to penalty and interest.

Interest and Penalties

For More Information

In general, interest and penalty apply to any portion of the tax

Call DRS during business hours, Monday through Friday:

not paid on or before the original due date of the return. If the

tax is not paid when due, interest will accrue at the rate of 1%

•

1-800-382-9463 (Connecticut calls outside the Greater

per month or fraction of a month from the original due date of

Hartford calling area only); or

the return until the tax is paid in full.

•

860-297-5962 (from anywhere).

Late Payment Penalty: If tax is due, the penalty for late

TTY, TDD, and Text Telephone users only may transmit

payment is 10% of the tax due or $50, whichever is greater.

inquiries anytime by calling 860-297-4911.

Late Filing Penalty: If no tax is due, the Commissioner of

Revenue Services may impose a $50 penalty for the late fi ling

Forms and Publications

of any return or report required by law to be fi led.

Visit the DRS website at to download and

print Connecticut tax forms and publications.

Form 207/207 HCC EXT Back (Rev. 12/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2